What are allocations and vesting in tokenomics, and why are they important?

Token allocation is the percentage of tokens that are distributed among different stakeholder groups within a crypto project. The allocation of tokens among different parties in a project, including the founders, venture capitalists (VCs), and the community, can provide insights into the project's long-term strategy and stability. The founders or team typically receive tokens based on their dedication and contribution to building the product, reflecting their commitment to the project's success. VCs, who take significant financial risks during the early stages of a project, often receive tokens at a lower cost through private funding rounds. When the lock-up period ends, VCs can influence the market price due to their larger token allocation and lower acquisition cost. The community, consisting of end-users or supporters, may receive tokens as incentives for their involvement. This can demonstrate the project's commitment to user engagement.

Vesting is the process of locking down cryptocurrency tokens for a predetermined amount of time before allowing the token holder to fully access or transfer them. Vesting schedules are tools that help all parties involved align their incentives. This guarantees that the team will deliver projects effectively and encourages community members to get involved in the network. These timetables also aid in encouraging a long-term commitment from all parties and reducing the danger connected with token dumping. They make sure that everyone is still committed to the project's long-term success by releasing tokens gradually.

A cliff represents a period during which no tokens are awarded, effectively delaying the commencement of the cryptocurrency vesting schedule. For instance, with a 6-month cliff period, tokens are distributed only after the sixth month has passed. The duration of the cliff can vary depending on the recipients within a project; investors and advisers may face a 16-month cliff, whereas marketing and collaborations might see a 3-month cliff. The vesting period officially begins once the cliff period concludes.

Furthermore, it's essential to note that when the cliff period ends, all funds that were supposed to be disbursed up to that point are released. For example, if a stakeholder owns 12% with a 12-month vesting schedule, they would typically receive 1% each month. However, if there's a 6-month cliff in place, they would receive 0% for the first five months and then receive a lump sum of 6% at the end of the sixth month, aligning with the accumulation of the vested percentage during the cliff period.

Allocations, vesting, and cliffs are important in building a crypto project for several reasons:

- Fairness and equality: Allocating tokens transparently and equitably ensures that all participants have a clear understanding of income distribution. It helps to avoid the concentration of power and wealth in the hands of a few early participants or founders.

- Control and governance: Proper allocation of tokens ensures that the project founders or team members have a reasonable level of control and influence over the project's development. In some cases, a part of control is handed over to the users, but if the project does not aim for full decentralization, then the main decisions (roadmap, development, and governance) are made by the management, regardless of token allocation.

- Incentivizing long-term commitment: Vesting schedules play a significant role in incentivizing team members and early investors to stay committed to the project. Locking tokens for a certain period encourages participants to focus on the project's success and rewards them for their continued dedication and contributions.

- Mitigating risks and aligning interests: Cliffs provide a mechanism to mitigate risks associated with early investors or team members losing interest or leaving the project shortly after receiving their tokens. By introducing a cliff, the project ensures that recipients demonstrate their commitment and contribute before gaining access to their tokens, aligning their financial interests with the success and longevity of the project.

- Avoiding token dumping and market manipulation: Proper allocation, vesting, and cliffs can prevent large token holders from immediately dumping their tokens on the market, which could lead to severe price fluctuations and market manipulation. By gradually releasing tokens over time, it creates a more stable and sustainable market for the project's tokens.

Overall, these mechanisms help create a sustainable environment for the crypto project, so it's wise to adhere to commonly accepted guidelines.

Best Practices

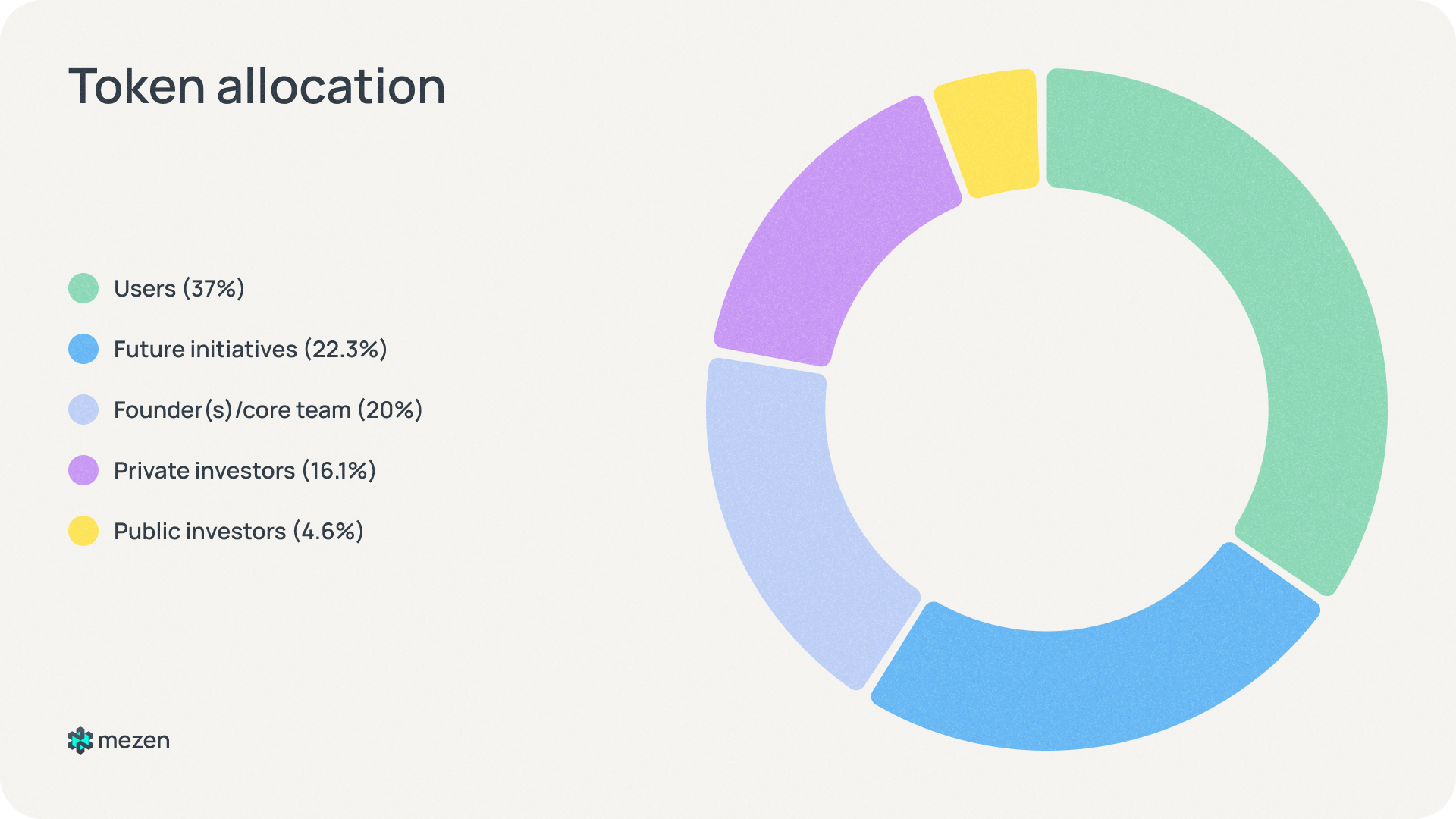

Since 2022, the largest portion of token allocation (from 35% to 37%) has been traditionally reserved for users. This is because allocating tokens to a wide base of community members helps to distribute power and influence, reducing the risk of centralization and aligning with the goal of decentralization. Additionally, allocating tokens to the community incentivizes active participation and engagement, as the tokens can be used for activities like staking, liquidity provision, and governance decisions.

The second largest allocation (approx. 27%) is reserved for future initiatives such as developing new features or pursuing partnership opportunities. This allocation ensures that crypto founders have enough funds for ongoing projects or can allocate funds to other parties in the future, such as the founder/team or private investors.

Approximately 20% of the tokens are allocated to the founder(s)/core team, while 16% are given to private investors. Projects commonly aim to distribute these portions equally or provide slightly more to the team than to the investors. This distribution helps alleviate pressure for short-term gains and allows for a focus on long-term commitment and sustainable growth.

Public investors are typically allocated around 4.6%-5% of the total tokens. Tokens sold in public sales usually don’t have long vesting periods, with most periods ending within 8.8 months. This means that buyers can't sell the tokens immediately after purchase, which helps to avoid a significant impact on the token's price.

Lock-up periods or vesting schedules are important for establishing a healthy economy in both primary and secondary markets. Lock-up durations for the core team are typically similar to or longer than those for investors to demonstrate long-term commitment. Treasury allocations should account for unforeseen obstacles and opportunities with a zero lock-up period, and community and ecosystem development categories should have a minimum lock-up period of 2 to 5 years to support scaling and avoid excessive token circulation.

Airdrop or incentive funds usually have no lock-ups or partial lock-ups ranging from 1 to 12 months. These funds are commonly used during a product's soft launch or after the market opens to acquire users and reward early contributors.

Overall, lock-up durations and cliffs are implemented to mitigate selling pressure and prevent drastic price drops. It is common practice to impose a minimum lock-up period of one year after the token generation event to discourage immediate selling by team members and investors.

Conclusion

In conclusion, token allocation and vesting are crucial components in the development and success of a crypto project with a token. They ensure fairness, control distribution, and long-term commitment among stakeholders while also mitigating risks and preventing market manipulation. By allocating tokens transparently and equitably, projects can distribute wealth more evenly and promote decentralization. Vesting schedules incentivize team members and early investors to stay committed and contribute to the project's growth. Cliffs help prevent early sellers from dumping tokens on the market, ensuring stability. Overall, these mechanisms play a crucial role in building a sustainable and thriving crypto project.

The research has been prepared by:

Comments ()