RWA Tokenization — what is it and what does it do?

Today, more and more attention in the crypto community is being paid to tokens that provide access to real-world assets. As of 1Q 2024, RWAs were the #2 asset in terms of quarterly returns, behind only memecoins. So what is RWA tokenization, and what are the benefits of these tokens you can already use now? Let's break it down.

What is RWA tokenization?

Real-world assets (RWA) — are tangible assets that exist in the physical world. Examples of these are real estate, commodities, art, and even US Treasuries. Real-world assets are a significant composition of the global financial value. For example, the global real estate market size is $613.0T, the debt securities market size is $133.0T, the public company stock market size is $100.5T, and the gold market size is $16.2T.

Tokenizing real-world assets involves representing the ownership rights of assets as on-chain tokens. In this process, a digital representation of the underlying asset is created, enabling on-chain management of the asset’s ownership rights and helping to bridge the gap between physical and digital assets.

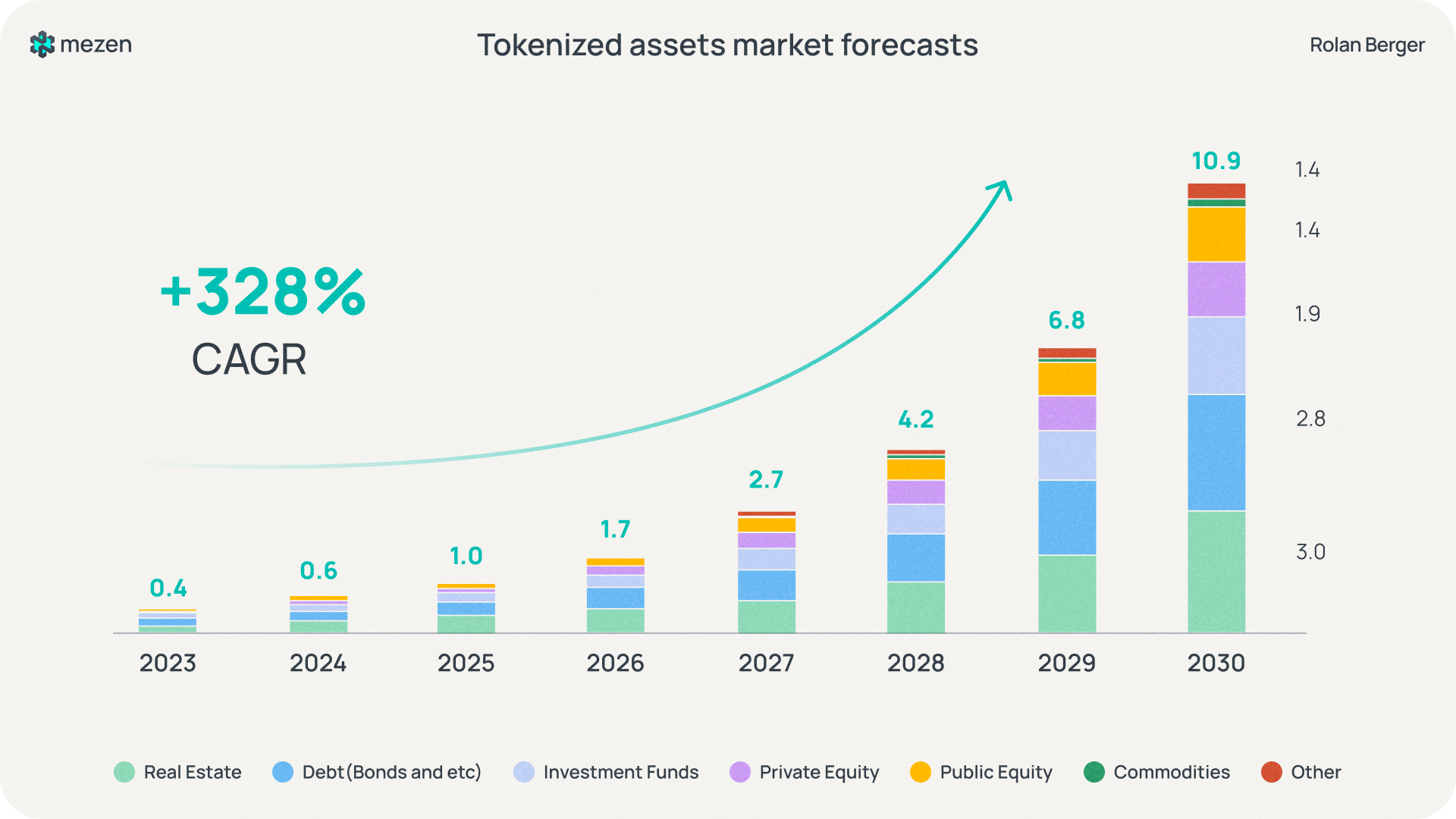

A study by Rolan Berger predicts that the market for tokenized assets will grow by about 40-fold from $0.3T recorded in 2022 to $11T by 2030 (Figure 1). According to the forecast, real estate and financial assets (including debts (digital bonds), private and public equities, and investment funds) are likely to dominate the tokenized market due to the sheer size of the underlying markets and the high prevalence of use cases. This estimation takes into account both on-chain asset tokenization, which is particularly relevant to the blockchain industry, and traditional asset fractionalization, such as exchange-traded funds (ETFs) and real estate investment trusts.

Figure 1. Tokenized assets market forecasts. Source: Rolan Berger

Tokenization process

The process of the emergence of a tokenized asset differs significantly from the issuance of classic cryptocurrencies. To tokenize real-world assets, a company must go through a complex process that includes not only issuing a digital token but also building a strong infrastructure with external counterparties in the financial environment. This process involves 6 basic steps:

- Defining the asset. Identifying the asset to be tokenized. It can be real estate, art, goods, commodities, financial instruments, liabilities, or any other valuable thing; in our case, it is bonds.

- Establishing the legal and regulatory framework. Selecting the jurisdiction of the project and taking into account securities laws, ownership rights, anti-money laundering (AML) compliance and know-your-customer (KYC) regulations.

- Selecting a technical solution and preparing project documentation. Selecting a blockchain platform and creating smart contracts that will serve as the basis of the Tokenized Bonds, as well as their audit. Next, the tokenomics of the project and general parameters of the tokens are determined, and a whitepaper is created. The outcome of the stage is the creation of a complete technical description of the project.

- Issuance and storage of the asset. Selecting a trusted service provider to organize the storage of physical assets, in our case is bonds, in a secure location that is neutral for all stakeholders. Subsequent issuance of tokens backed by these real assets and the creation of a digital repository for them.

- Creation of a secondary market for tokenized assets and control of redemption mechanisms. For this purpose, mechanisms are established and controlled to allow investors to sell their tokens back or redeem them for the underlying asset.

- Asset maintenance and reconciliation. After an asset is placed on the market, it requires ongoing maintenance, including preparation of regulatory, tax, and accounting reports, notification of corporate actions, etc.

What problems does RWA tokenization solve?

The category of low-liquid assets (real estate, art objects, etc.) has the greatest benefits from the use of tokenization technology. The main reasons for illiquid assets include:

- High entry threshold for mass investors, given the high value of the assets.

- Inability to fractionalize inherent utility (e.g., dividing 1 object among a wide range of investors).

- High associated costs to hold and maintain assets (e.g. fine art, vintage cars, vineyards, etc.).

- Limited accessibility due to regulatory hurdles (passing KYC, obtaining qualified investor status and its analogs, etc.).

- Limited range of potential buyers for subsequent resale of the asset.

On-chain asset tokenization provides an opportunity to eliminate many of these barriers associated with the illiquidity of assets, as well as the current method of traditional fragmentation. Asset tokenization helps to rethink the complex process of finding and selecting investors with investment opportunities, as well as subsequent opportunities in the secondary market after making investments.

Evolution of tokenized RWAs in the crypto space

One of the earliest forms of RWA that appeared on the cryptocurrency market exists in the form of stablecoins. Since 2014, companies such as Tether ($USDT) and Circle ($USDC) have been issuing tokenized stable assets that are backed by real collateral, such as bank deposits, short-term bonds, and even physical gold. The existence of stablecoins made it possible to create a stable unit of exchange in an unstable environment.

The next wave of RWAs in the cryptocurrency space was 2022, highlighting 2 key challenges:

- Reduced overall trust and liquidity in the sector. Incidents related to the collapse of the Terra stablecoin ($UST, $LUNA) and the centralized exchange FTX ($FTT) destabilized the cryptocurrency market. The consequences were a massive migration of capital from tech cryptocurrency tokens and DeFi protocols to stablecoins, and a decrease in attention and investment from institutional investors.

- Declining yields on DeFi instruments. Between mid-2022 and late 2023, the returns on DeFi instruments nearly equaled those of TradFi. Given the lower risk inherent in the TradFi market, DeFi participants began to move out of DeFi, investing their capital in the TradFi market to increase their risk/return ratio.

The answer to these challenges was the development of classic TradFi investment instruments (bonds, precious metals, real estate, etc.) within the DeFi ecosystem. RWA tokens allowed investors to isolate capital from highly volatile market segments while not withdrawing liquidity from the ecosystem to invest in instruments with familiar mechanics and a more attractively priced risk/return ratio.

Types of RWA tokens

Stablecoins

Currently, the majority of real-world assets (RWA) are USD-pegged stablecoins.

The market capitalization of stablecoins is $159.9B, demonstrating a growth of more than 22.5% since the beginning of the year. The dominance of two coins with a capitalization of about 90% is clearly distinguished in this sector: Tether ($USDT) with $109.7B, Circle ($USDC) with $34.0B.

The principle of the leading fiat-baked stablecoins is similar: the appearance of 1 digital token is possible only if at least 100% of its value is secured by real assets. Token collateral is in the form of highly liquid assets: cash reserves in banks, short-term bonds, repurchase transactions (repo), etc. These assets are either held in the world's largest banks with the highest capital, liquidity, and supervisory requirements or managed by large funds.

Third parties are also involved in the projects, not only to store the assets but also for auditing (checking the reliability and relevance of information on token collateral). For example, for the USDC token, everyone can familiarize themselves with the daily, independent, third-party reporting on the portfolio, which is publicly available via BlackRock

This type of RWA token also includes stablecoins pegged to other currencies.

Tokenized bonds

One of the reasons for the explosion of interest in real-world tokenized assets has been the rise in yield rates on traditional low-risk assets (particularly government bonds).

Tokenized bonds are digitized rights to own a real-life bond recorded on a blockchain. While having all the advantages of traditional bonds (fixed income in the form of coupon payments, reduced investment risk), tokenized bonds have additional advantages. Firstly, recording on the blockchain increases the security and transparency of holders' registers, and secondly, investors have the option of fractional ownership.

The major actors present in the sector are Franklin Templeton ($FOBXX), Backed Finance ($bIB01, $bERNA, $bERNX, $bC3M, $bIBTA, $bHIGH), Matrixdock ($STBT), Ondo Finance ($OUSG, $USDY).

Each representative of the sector tokenizes assets using unique mechanics (based on the status of the company, its jurisdiction, etc.). However, one thing remains common: tokens generate revenue by investing user assets (usually stablecoins) in traditional investments such as government and corporate bonds.

Tokenized real estate

Tokenized real estate refers to the representation of a real estate property or its cash flows as a blockchain token (or tokens) to increase liquidity, streamline processes, and enable digital ownership.

When utilizing blockchain technology for tokenized real estate, either non-fungible tokens (NFTs) or fungible tokens are required, depending on the goal and what is being tokenized. NFTs are useful when a property, or groups of properties, are being considered as a whole (i.e., one or more properties, one token). Fungible tokens, on the other hand, are useful for dividing a whole into parts.

Real estate tokenization can be used by an investor for a variety of purposes:

- Simple Tokenized Real Estate. The simplest example of tokenized real estate is representing a single real-estate property as an NFT.

- Dynamic Tokenized Real Estate. The tokenization example above can be further enhanced using dynamic NFTs (dNFTs).

- Fractionalized Real Estate. A compelling use case for real-estate tokenization is fractionalization, or enabling fractional ownership of a property. This approach uses fungible tokens.

- Tokenized Real Estate Cash Flows. With blockchain-based tokens, it’s possible to separately tokenize ownership of a particular property from the cash flows that the property generates, unlocking liquidity for property owners.

- Tokenized Real Estate Baskets. It’s also possible to create a tokenized representation of a basket of real estate properties and their cash flows.

Commodity-baked tokens

The market capitalization of top commodity-baked tokens is $1.2B. Despite the variety of underlying assets, the most popular tokens are those that provide access to precious metals trading (gold, silver, etc.). The dominance of two coins with a capitalization of about 81.8% is clearly distinguished in this sector: Tether Gold ($XAUT) with $577.5M, and PAX Gold ($PAXG) with $430.5M.

Similar to stablecoins, this type of token requires full collateralization of value, but the underlying asset is commodities (precious metals, oil, agro-crops, etc.). The investor's income is generated by the change in the price of the underlying asset during trading on traditional financial markets. To display asset prices, protocols often use oracles, which are infrastructure protocols that provide off-chain information to the blockchain.

Despite the dominance of tokenized precious metals, tokens backed by other commodities have also been launched. For example, the Uranium308 project has released tokenized uranium, which is pegged to the price of 1 pound of U3O8 uranium compound. It can even be redeemed, but strict compliance protocols will first need to be passed.

Tokenized credits

Another possible direction for the tokenization of real-world assets is the tokenization of loans. Protocols that provide tokenized loans are platforms whose operating principle is similar to bank lending.

There are 3 main parties involved in the loan process:

- Lenders/Liquidity Providers. Market participants who provide temporary free funds to liquidity pools to earn money.

- Borrowers. Market participants (mainly institutional borrowers, such as companies) use borrowed funds from liquidity pools for a fee.

- Auditors. The role of auditors is to ensure that borrowers on board are not engaged in any fraudulent activities through their due diligence process. The lending protocol may also serve as the auditor.

Loan disbursement is based on a pools mechanism. Maple Finance ($MPL) thereafter sets the pool conditions (loan size, duration of disbursement, frequency of repayments, interest rates for the borrower/lenders, etc.), and lenders choose a pool for depositing funds based on the formed conditions and personal preferences. In Goldfinch ($GFI) borrowers create the pools and determine the initial terms and conditions, after which lenders are included in the chain. Centrifuge ($CFG) comes around to allow for more forms of real-world assets to be brought onto the ecosystem and has a slightly different mechanism by incorporating NFTs.

An important condition for granting loans is the formation of a white list and the borrower's completion of due diligence procedures. This is a necessity for the safety of lenders' funds but does not protect the platform from non-repayment of debt.

Bottom line

The trend of tokenization of real-world assets is becoming increasingly popular. Even though the need for these solutions was mainly driven by market circumstances (series of defaults in 2022, reduction of DeFi projects' returns to the level of TradFi instruments), the new products have chosen their development trajectory, focusing on combining the advantages of both markets (higher returns with reduced risk from TradFi, transparency, security, and increased accessibility from DeFi). Although the sector is still in its infancy, users can already access products that have raised millions of dollars and have stood the test of time.

Comments ()