FTX: an ambiguous end to a 1.5-year-long story

Key takeaways

- FTX has been growing and gaining popularity since 2019, becoming one of the major centralized exchanges in 2021.

- The FTX collapse occurred within 10 days in November 2022. The main reasons were the problems at sister firm Alameda Research, the transfer of FTX users' funds, Alameda's "infinite" wallet on the exchange, and the concentration of management authority in insufficiently competent people.

- To top off the story, on March 28, 2024, former FTX CEO Sam Bankman-Fried was sentenced by a Manhattan federal judge to 25 years in prison.

- Remember that a company's current reputation is largely formed based on people's opinions and does not always describe an objective state of affairs.

FTX — an ambitious new player on the CEX market

FTX Exchange is a CEX specializing in spot markets, derivatives, options, volatility, and leveraged products. It was founded in 2018 by MIT graduate and former Jane Street Capital international exchange-traded fund (ETF) trader Sam Bankman-Fried.

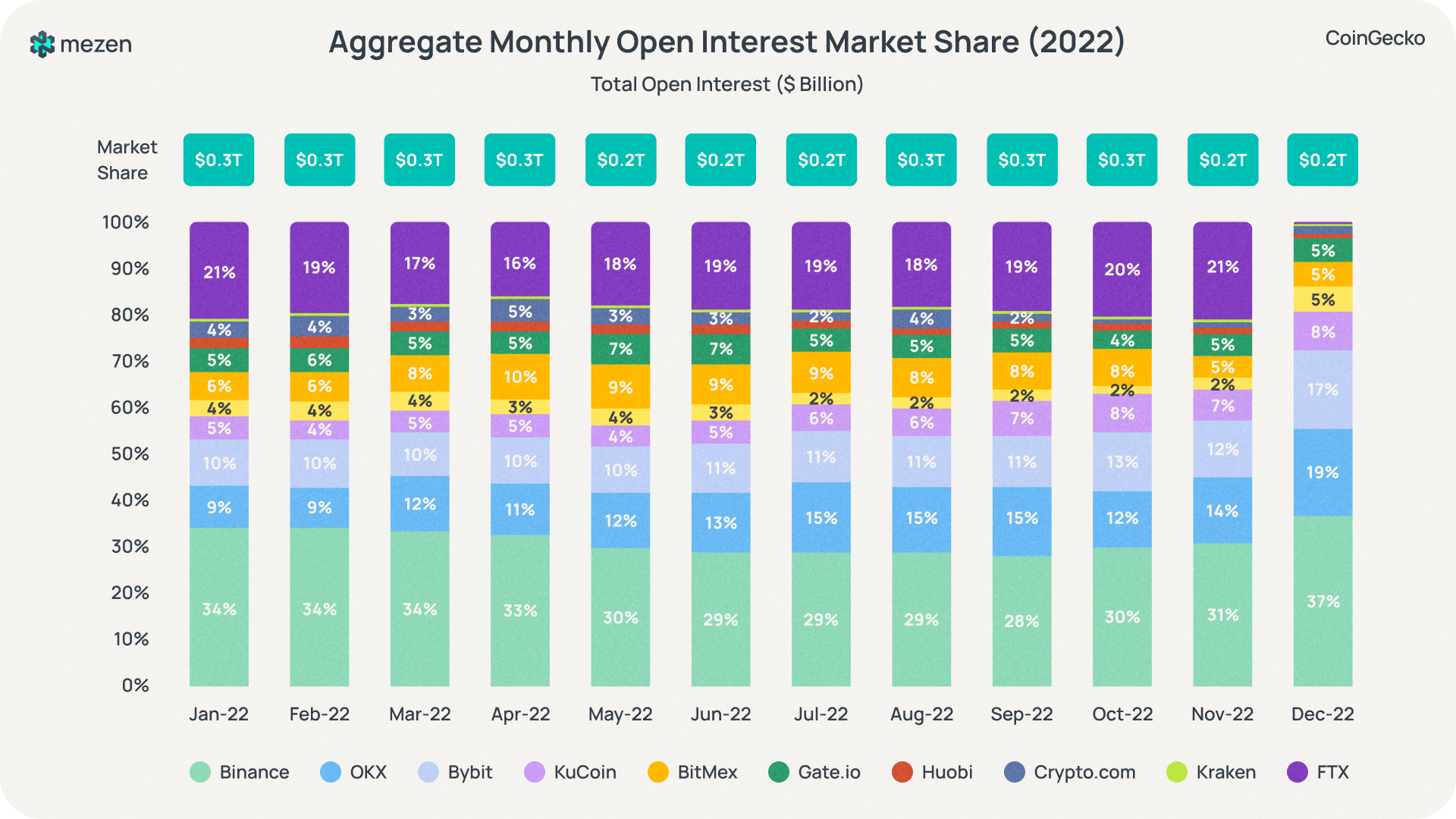

The cryptocurrency exchange held a strong position in the market, gaining particular popularity in 2021, topping the CEX tops on various metrics:

- 2nd by monthly open interest

- 4th by monthly perpetual trading volume

- ranked in the top 5 for total trading volume

- over 1.2M platform users

- $21B — peak trading volume in 24 hours

Figure 1. Aggregate monthly open interest market share, 2022. Source: CoinGecko

FTX Exchange ran two trading arms: FTX, an international Bahamas-based platform, and FTX US, a separate U.S. affiliate where only U.S. residents could trade.

The main reasons that led to the collapse

The collapse of FTX occurred with rapid speed but was the result of a long-term series of poor management decisions as well as blind trust from users of the platform:

- Close relationship. Alameda’s troubles helped lead to the bankruptcy of FTX. Sam Bankman-Fried has reportedly made customers wire transfer money to FTX through Alameda bank accounts at Silvergate and other banks.

Meanwhile, Alameda was the primary market maker for FTT tokens, buying and selling the majority of them. The FTX token (FTT) was used by users to trade their crypto assets on the crypto exchange and receive a discount. To support its trading activities, Alameda used its FTT holdings as collateral to obtain additional loans from cryptocurrency lenders.

There are also more radical opinions. The New York Times argues that “Alameda’s need for funds to run its trading business was a big reason Mr. Bankman-Fried created FTX in 2019” - Alameda's balance sheet. As of June 30, 2022, Alameda had $14.6B in assets. Among the assets stand out: $3.7B "unlocked FTT" (the largest item), $2.2B "secured FTT" (the third largest item). This shows that trading giant Alameda relies on a foundation consisting mostly of coin that an affiliated company invented rather than an independent asset such as fiat currency or other cryptocurrency.

FTX had an arrangement with Alameda Research that allowed the latter to receive client funds. Clients were encouraged to send wire transfers through Alameda's accounts at Silvergate Capital, Signature Bank, Trust Bank, and other similar banks. The use of the scheme led to problems in record-keeping and management. - Unwarranted privilege. According to testimony, Bankman-Frieda directed former FTX chief technology officer Gary Wang to alter the exchange's computer code to allow Alameda to borrow unlimited amounts of money, a privilege not granted to other users of the exchange. This allowed Alameda to borrow substantial funds from FTX.

- Lack of competence. Leading positions at FTX and Alameda Research were held mostly by people with close ties to each other but little industry experience. In particular, the CEO of Alameda was 28-year-old Caroline Ellison. Before joining Alameda as a trader in March 2018, Ellison spent 19 months as a junior trader at Jane Street after graduating from Stanford University. In the 2020 podcast, Ellison revealed that Jane Street was her first job out of college.

The same suspicions are being raised about Gary Wang, Nishad Singh, Sam Trabucc, and others.

Timeline of events

Inconvenient report and public reaction: November 2022

- On Nov. 2, 2022, the FTX collapse was connected to the cryptocurrency exchange's strong ties with Alameda Research, a crypto hedge fund also established by Bankman-Fried.

Serious concerns about FTX arose when CoinDesk published an article revealing that a large portion of Alameda Research's holdings were in FTT, a token developed by FTX to provide users of the exchange with discounted trading fees.

As FTT is not easily convertible to cash, the report raised worries about the capital reserves at Alameda Research and consequently at FTX. - On Nov. 6, Changpeng Zhao (CEO of Binance exchange) announced that he plans to sell off Binance's FTT token holdings (totaling $580 million) due to "recent revelations that have come to light," citing a CoinDesk report. He compared FTX's situation to the 2022 collapse of TerraUSD and LUNA, which crashed the cryptocurrency market and cost investors billions of dollars.

- CZ's announcement sparked high interest from investors and traders as suspicions arose that FTX lacked the liquidity needed to secure transactions and maintain buoyancy.

The withdrawal of cash from the platform caused the value of FTT to collapse by more than 80%. The value of other coins, including BTC and ETH, also fell, with bitcoin dropping to a two-year low.

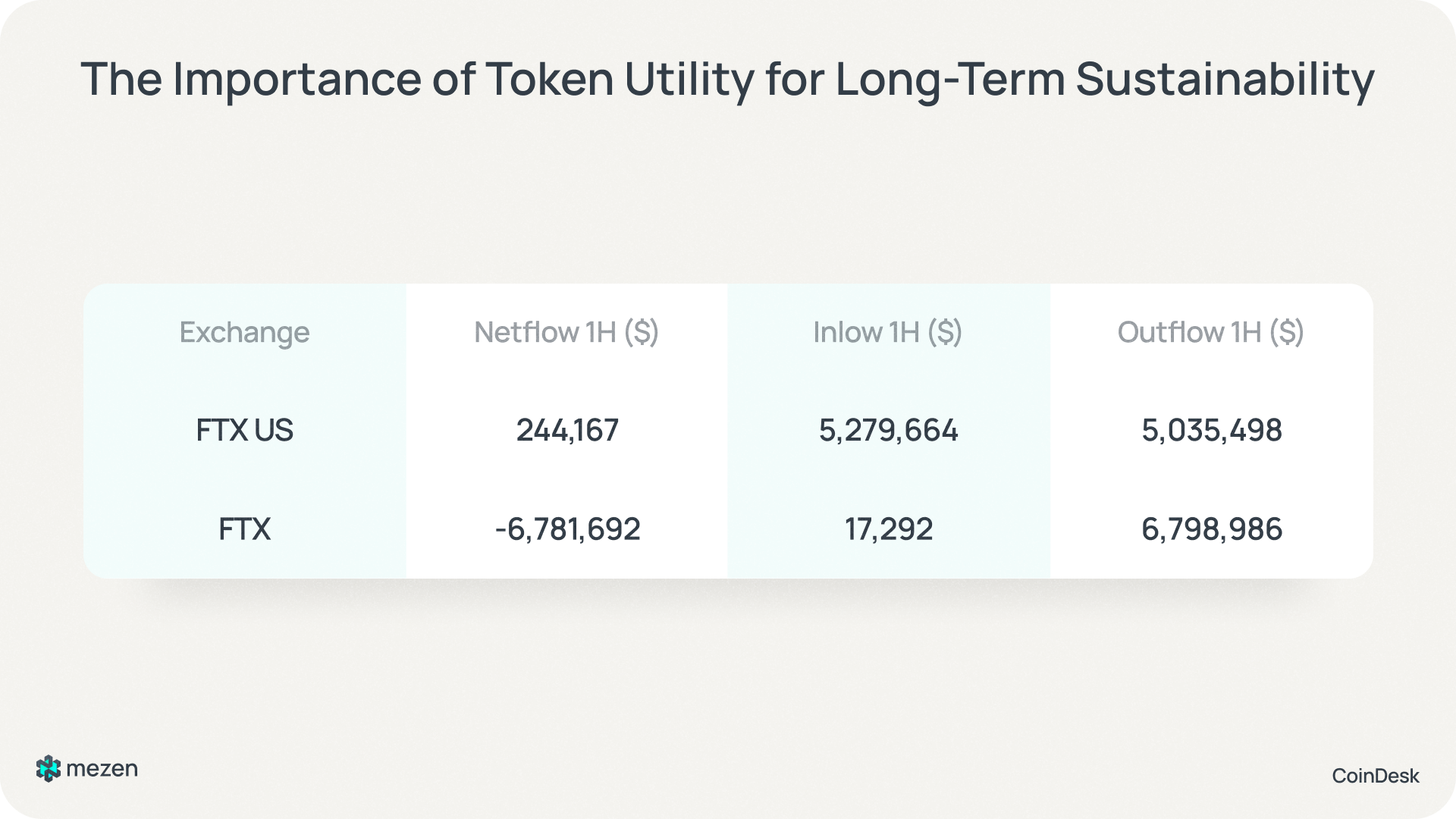

Sam Bankman-Fried later reported that more than $5 billion had been withdrawn from the platform on Nov. 6 (Figure 2).

Figure 2. Withdrawal volumes from FTX platforms and FTX.US. Source: CoinDesk

Emergency liquidity search and termination: November 2022

- On Nov. 8, Zhao and Bankman-Fried signed a non-binding letter of intent for Binance's acquisition of non-U.S. affiliate FTX. The main reason is to bail out the bankrupt exchange to prevent a larger market crash.

- On Nov. 8, FTX suspended all non-fiat customer withdrawals.

- On Nov. 9, Binance withdrew from the deal. CZ said that Binance had completed a "corporate review" and decided that it would not acquire FTX. The decision was prompted by reports of “mishandled customer funds” and “alleged U.S. agency investigations”.

Figure 3. Sam's reaction to Binance's rejection of the deal. Source: Twitter

- On Nov. 9, the Securities and Exchange Commission and the Justice Department began investigating the collapse of FTX.

- Sequoia Capital (venture capital firm) wrote down its $210 million stake in FTX to $0.

"We are in the business of taking risks," Sequoia Capital said in a public letter. "Some investments will surprise to the upside, and some to the downside." - On Nov. 10, the Bahamian financial regulator freezes FTX's assets.

The Securities Commission of the Bahamas said it was aware of public statements indicating that FTX customer funds were potentially "mishandled" and "mismanaged".

Bankruptcy declaration, change of CEO, and attention of legislative institutions: November 2022

- On Nov. 11, FTX, along with an extensive corporate structure that includes about 130 other affiliates, filed for Chapter 11 bankruptcy protection. The bankruptcy documents show that FTX had assets and liabilities of $10 billion and $50 billion, respectively.

- Bankman-Fried stepped down as CEO and was replaced by John J. Ray III, who guided energy company Enron through bankruptcy in the 2000s.

- On Nov. 11, FTX.US also temporarily froze withdrawals, despite previous assurances that FTX.US was not affected by FTX's liquidity problems. Withdrawals were later resumed.

- In the evening, more than $600 million was withdrawn from FTX and FTX.US wallets as a result of the hack. FTX reported the hack on its support channel in Telegram.

- On Nov. 12, the Wall Street Journal reported that FTX lent customer deposits to Alameda Research to help it meet its obligations, and top Alameda Research executives knew about it, prompting further scrutiny of the relationship between Alameda Research and FTX.

- On Nov. 14, the collapse of cryptocurrency exchange FTX became the subject of an investigation by federal prosecutors in New York.

The investigation looked into whether FTX violated securities laws when it transferred customer funds to Alameda Research.

Defeated financial report, indictment on 8 financial crimes, extradition to the US: November 2022 — January 2023

- On Nov. 14, the Financial Times published the FTX Balance Sheet dated November 10. The report declared $9 billion in liabilities and only $900 million in highly liquid assets (Figure 4).

Figure 4. Revealed FTX balance sheet. Source: Financial Times

- On Nov. 17, as part of a court filing, John J. Ray III revealed to the public the horrific picture of FTX's financial performance.

"From compromised systems integrity and faulty regulatory oversight abroad to the concentration of control in the hands of a very small group of inexperienced, unsophisticated, and potentially compromised individuals," Ray said.

"This situation is unprecedented," he added. - On Dec. 12, at the request of the U.S. government, Bahamian authorities arrested Bankman-Fried for extradition on 8 criminal charges, including wire fraud and conspiracy to defraud investors.

- On Dec. 13, the U.S. Securities and Exchange Commission charged Bankman-Fried with defrauding investors.

"FTX’s collapse highlights the very real risks that unregistered crypto asset trading platforms can pose for investors and customers alike. While we continue to investigate FTX and other entities and individuals for potential violations of the federal securities laws, as alleged in our complaint, today we are holding Mr. Bankman-Fried responsible for fraudulently raising billions of dollars from investors in FTX and misusing funds belonging to FTX’s trading customers", said Gurbir S. Grewal, director of the SEC's Division of Enforcement, in a statement. - On Dec. 13, Wray testified before a House committee in place of Bankman-Fried. He told lawmakers that FTX had “no record-keeping whatsoever".

- On Dec. 19, former Alameda Research CEO Caroline Ellison and FTX co-founder Gary Wang pleaded guilty to "charges arising from their participation in schemes to defraud FTX’s customers and investors, and related crimes", according to federal prosecutors.

- On Jan. 3, 2023, Bankman-Fried appeared in a New York court where he pleaded not guilty to each of the charges against him.

Bail revocation, lengthy trial, finals: January 2023 — March 2024

- On Aug. 11, Bankman-Fried was revoked bail and immediately transferred to the custody of the U.S. Marshals. Prosecutors alleged that Bankman-Fried falsified witness statements, citing his decision to turn over Caroline Ellison’s records to the New York Times. Bankman-Fried was then held at the Metropolitan Detention Center in Brooklyn while awaiting trial.

- On Oct. 3, the trial began. In the following weeks, Caroline Ellison would become one of the prosecution's star witnesses, stating that Bankman-Fried did not believe the rules applied to him. Bankman-Fried testified in his defense during the 3 days of the hearing.

- On Nov. 2, a jury found Bankman-Fried guilty on all counts of federal fraud and conspiracy. In total, the charges carry a maximum sentence of 110 years in prison.

- On Feb. 27, 2024, Bankman-Fried's attorneys filed a brief saying he should receive a prison sentence of 5.25 to 6.5 years.

- On Mar. 15, prosecutors said Bankman-Fried should get 40 to 50 years in prison because of the "enormous scale of the fraud".

- On Mar. 28, a federal judge sentenced Bankman-Fried to 25 years in prison and the judge asked that Sam Bankman-Fried forfeit more than $11B to help repay customer funds that were lost. "This was a very serious crime", said U.S. District Judge Lewis Kaplan.

Serious implications for the entire cryptocurrency market

Lack of liquidity on the platform, accompanied by high public attention, as well as the unsuccessful choice of candidates holding executive positions in affiliated companies, had a direct impact on different groups of stakeholders.

First of all, the exchange's clients, who placed funds on deposits, were negatively affected. The total damage for users, who did not manage to withdraw funds until November 10, 2022, amounted to more than $8B. Despite the court verdict and the obligation to compensate for the losses, it remains unclear in what timeframe and in what amounts the funds will be reimbursed.

The situation had no less significant consequences for legal entities, which interacted with the Exchange in one way or another.

Consider in more detail the particular companies that suffered the most financial and reputational damage in the FTX litigation.

- BlockFi. BlockFi has frozen withdrawals and filed for Chapter 11 bankruptcy, mainly because it was affiliated with FTX. The company had an outstanding $275 million FTX US loan on its balance sheet, as well as other liabilities and assets ranging from $1B to $10B.

- Gemini & Genesis Global Capital. On November 9, 2022, Gemini co-founder Cameron Winklevoss wrote that the platform had no material ties to FTX, FTT, or Alameda. However, Gemini told clients on Nov. 16 that they would not be able to withdraw funds from Gemini Earn, a program that paid up to 8% interest on assets that clients lent out. The problem lies with Gemini's third-party lending partner, Genesis Global Capital, which froze withdrawals amid liquidity concerns.

- Crypto.com. Crypto.com CEO Kris Marszalek wrote that the company's direct exposure to the "collapse of FTX" is "immaterial" and amounts to less than $10 million in company equity. The platform has suspended withdrawals from stablecoins USD and USDT on the Solana network but did not explain why.

- Also affected by the exchange's actions were lenders Celsius and Voyager Digital, which made loans to FTX and Alameda Research with grossly undervalued collateral and an omission of the risk profile of the loans' repayment.

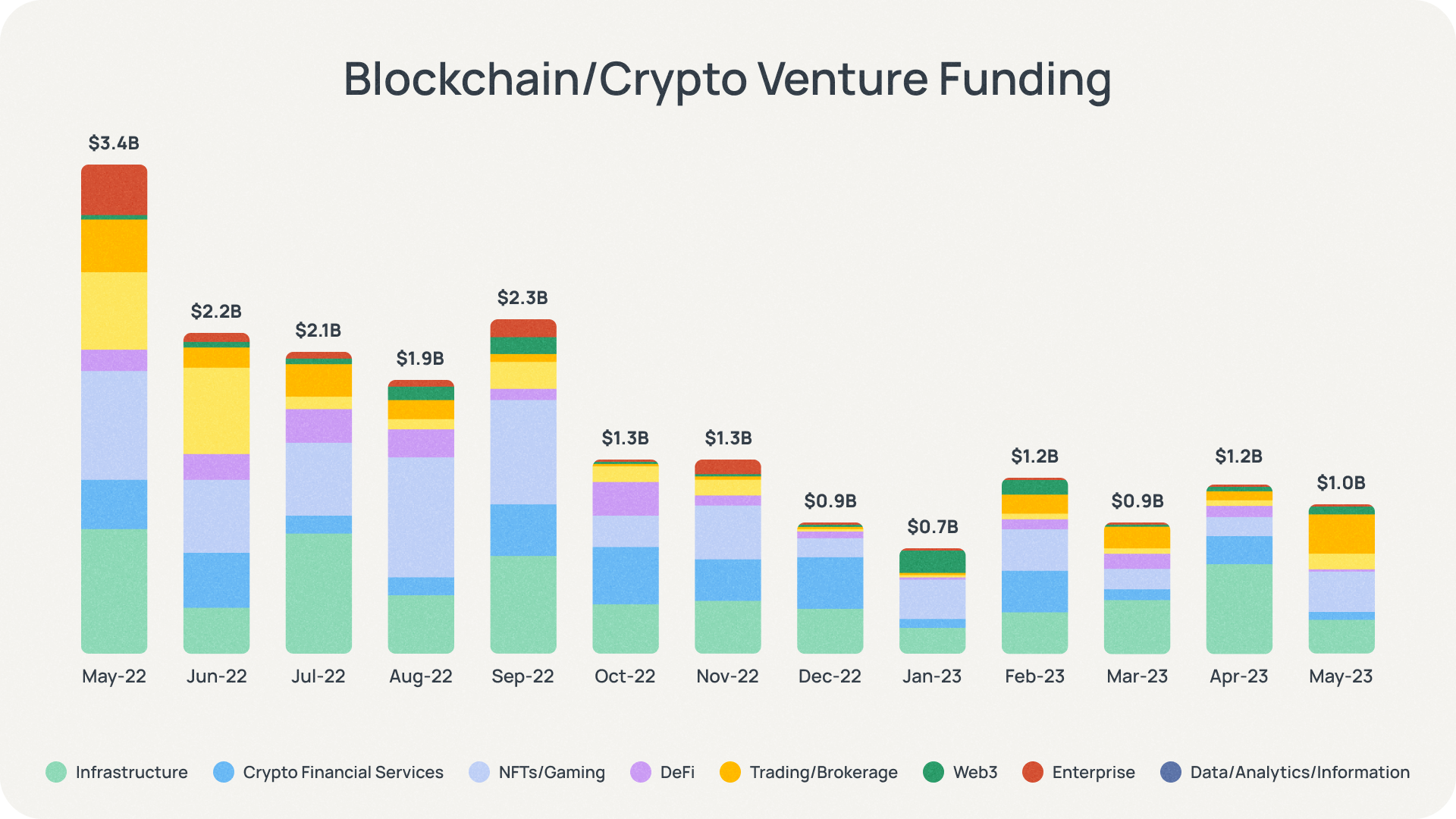

Beyond the direct impact on the companies and individuals involved with FTX, FTX.US, and Alameda Research, the bankruptcy impacted the entire cryptocurrency industry. Although the Total Crypto Market returned to its previous values within 3 months (beginning of February 2023), the situation was an additional catalyst (together with the Terra and LUNA cases) for the beginning of a prolonged bear cycle, cooling the markets and reducing the interest of large investors. Thus, blockchain/cryptocurrency-related Venture Capital investments declined 70.6% year-over-year (Figure 5).

Figure 5. Blockchain/Crypto Venture Funding. Source: The Block

Lessons learned

The rapid demise of cryptocurrency exchange FTX in 2022 had a detrimental effect on the cryptocurrency industry, causing widespread distrust and bringing down the cryptocurrency services that did business with it.

The main lesson to be learned from this situation is to understand the importance of structured procedures in selecting counterparties. A company's current reputation is largely formed based on people's opinions and recognition by current market leaders, whose work is also subject to the human factor and the pursuit of personal interests.

- Key positions at Alameda Research were held by people with limited experience in the trading and cryptocurrency industry. A detailed approach to reviewing social media profiles as well as statements on podcasts/interviews revealed that candidates were chosen primarily based on personal connections.

- No clear business development strategy. Many of SBF's actions and statements, the consequences of which directly impacted the stock exchange, were characterized by spontaneity, chaos, and impulsive.

- Lack of diversification in investment decision-making. Alameda Research invested primarily in projects within 1 ecosystem (Solana), which created a high concentration of capital and significant investment risks.

- Lack of focus on building a "personal brand". SBF's social media behavior could have been brash, aggressive, and even unethical. While Sam's account was not a staple for FTX, today the power of a personal brand plays a significant role. Appealing behavior increases the risk of negative associations with a product, reducing the interest of large investors in making a long-term investment.

All of these circumstances are red flags for the Due Diligence procedure. Due Diligence will allow you to look at the counterparty from different angles, obtain a comprehensive assessment, and, ultimately, build healthy long-term relationships for effective cooperation.

Comments ()