Trends and market conditions impacting startup fundraising

Key takeaways

- Over the past two years, foreign economic uncertainty and crypto-winter have changed the investing landscape.

- The annual volume of venture investments in Web3 projects decreased by 74% year-over-year (2022 – $26.6B in 2.9k deals, 2023 – less than $7B in 1.6k deals).

- Many investors foresee a more controlled and steady market, with capital flowing less freely than in the past.

- Startups should expect more realistic valuations and a tougher bar for obtaining funding as investors evaluate their proposals more closely.

- To stand out, tailor your communication and pitch by deeply understanding your investors' latest deals, investment focus, and market activities. A one-size-fits-all strategy would not result in a closed round.

Introduction

Access to funding is essential for startups, supporting their growth, innovation, and ability to bring new ideas to the market.

However, obtaining venture finance is a highly competitive process that necessitates a thorough awareness of current investment trends as well as the capacity to manage changing market conditions.

This study intends to combine an analysis of current venture financing trends with an evaluation of how market factors, such as economic upheavals or industry-specific developments, affect startup fundraising methods and success.

Current venture financing trends

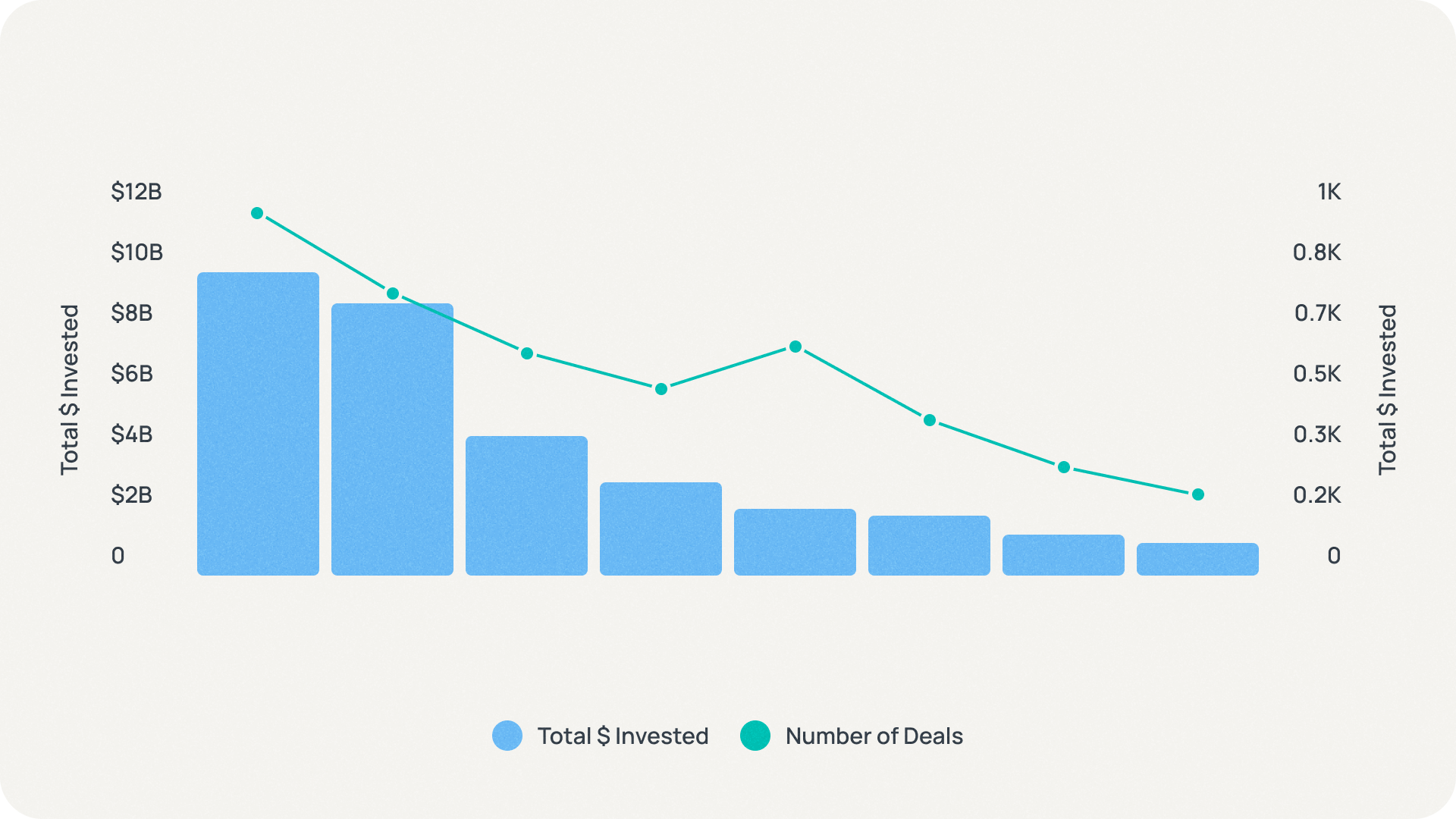

In recent years, the investment landscape has undergone significant changes due to foreign economic uncertainty and the crypto-winter phenomenon. Investors across the world have been revisiting their attitudes towards the concept of risk-return, resulting in a reduction in high-risk assets in their portfolios and a preference for conservative investments. As a result, venture capital funds (VCs) have reduced the volume of investments in Web3 projects (Figure 1). The decrease in the annual amount of investments raised by VCs in Web3 projects was 74% year-over-year (2022 - $26.6B in 2.9k deals, 2023 - less than $7B in 1.6k deals).

Figure 1. Funding to VC-backed Web3 startups by quarter. Source: Crunchbase

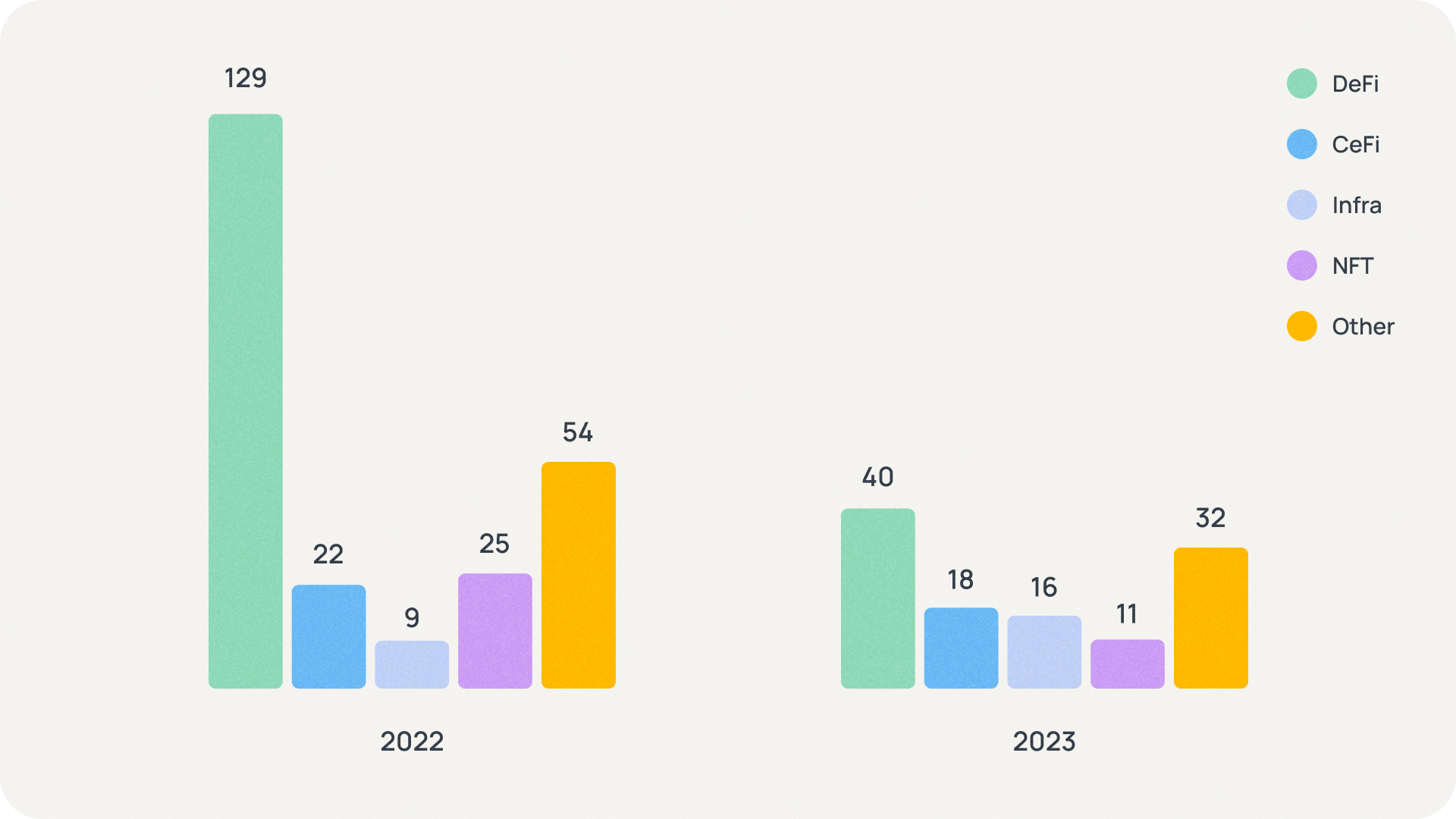

The sectors that have been most appealing to VC investors, in terms of both the number of deals and investment volumes, include NFT/gaming, infrastructure, CeFi, and DeFi.

Despite the general sense of caution, several success stories have emerged, providing light on certain subjects within Web3 that have sparked significant interest and potential. Notably, among the protocols that raised over $100 million in funding during 2023 are:

- Wormhole ($225M, cross-chain messaging platform)

- LayerZero ($120M, omnichain interoperability protocol)

- Worldcoin ($115M, globally-inclusive identity and financial network)

- Blockstream ($125M, blockchain technology solutions for financial market)

- Blockchain.com ($110M, trading platform)

Despite the overall cautionary climate, these success stories highlight the endurance and desirability of specific industries within the Web3 landscape.

Additionally, the promising start to 2024, marked by the government's approval of several Bitcoin ETFs and the continued upward trajectory of the primary cryptocurrency's value, may serve to renew the interest of venture capitalists in the Web3 sector.

Market conditions impacting venture financing for Web3 startups

While success tales of startups getting venture capital (VC) funding during the bullish market of 2021 are encouraging, founders should limit their expectations in the current environment. Many investors foresee a more controlled and steady market, with capital flowing less freely than in the past.

This shift in market conditions needs a more pragmatic approach by both founders and investors. Startups should expect more realistic valuations and a tougher bar for obtaining funding as investors evaluate their proposals more closely.

Indeed, the realization of a more comprehensive investment approach is indicated by the reduction in the number of Web3 projects facing bankruptcy (Figure 2). The number of projects declaring bankruptcy or ceasing operations decreased by more than 50% (2022 – 239 projects, 2023 – 117 projects), and the amount of funding raised decreased by 76% (2022 – $4B, 2023 – $0.9B). These circumstances reflect the gradual maturation and stabilization of the industry.

Figure 2. Number of Web3 project failures (total financing, sector distribution). Source: RootData

Investors are becoming more distinctive, focusing on firms that not only have engaging narratives but also have solid metrics and significant growth prospects. According to industry experts, businesses seeking capital are increasingly prioritizing liquidity and growth readiness.

In this environment, founders must be prepared to go through a more rigorous due diligence process while demonstrating a clear path to profitability and scale. Venture capital firms, on the other hand, are adopting more conservative investment tactics, emphasizing comprehensive analysis and risk reduction to safeguard the interests of their investors.

While accessing venture funding may be more difficult, this moment provides an opportunity for founders and investors alike to rebuild a more sustainable and strong ecosystem based on data-driven decision-making.

Analyzing market data and investor behavior

To stand out, tailor your communication and pitch by deeply understanding your investors latest deals, investment focus, and market activities. A one-size-fits-all strategy would not result in a closed round.

First and foremost, do not attempt to contact investors from other domains; you will not only waste valuable time but also put your entire outreach infrastructure at risk of being banned for spamming.

So, how to find the right one?

- Use online databases. Platforms such as Crunchbase, DefiLlama, DropStab, etc. provide essential information on investors' portfolios, recent investments, and areas of interest. Explore these datasets to learn about your prospective investors' previous deals, sector preferences, and investment phases (seed, Series A, B, etc.).

- Understand VC priorities. VCs have several investing methods and priorities. Take the time to learn about your VC potential partner's objectives, investment thesis, and areas of expertise. Tailor your communication to reflect their priorities, indicating your dedication to a mutually successful relationship.

- Follow investor news & announcements. On social media, investors frequently publish information about their newest deals, portfolio updates, and market insights. Follow your target investors on platforms such as Telegram, Twitter, and LinkedIn to remain up to speed on their activity and learn about their current investment strategies and priorities.

- Conduct thorough market research. Investors are aware of market trends, industry disruptions, and upcoming technology. By completing extensive market research and staying up-to-date on the newest changes in your industry, you can demonstrate your expertise in the market and position your startup as a timely and relevant investment option.

Building long-term VC relationships and loyalty

Building long-term connections with venture capitalists (VCs) and cultivating loyalty are key components for a startup's continued success.

In the complex dance of startup fundraising, the importance of developing long-term relationships with venture capitalists cannot be emphasized. Nurturing these connections necessitates an approach based on open communication, common values, and continuous engagement.

Startups that prioritize long-term connections over short-term earnings can create loyalty and lay the groundwork for long-term success and fundraising campaigns, even in a moment of a grim market situation.

- Transparent communication. Prioritize open and honest communication with your venture capital partners right away. Share both triumphs and struggles to build trust and set the groundwork for a strong partnership.

- Common vision & values alignment. Seek out VCs whose mission is compatible with your startup's objectives. A shared vision promotes a sense of purpose and dedication, strengthening your collaboration's foundation.

- Regular updates beyond funding rounds. Don't limit your communication with VCs to fundraising rounds. Schedule regular check-ins to deliver updates on your startup's development, address difficulties, and solicit feedback. Maintaining a continuous discussion strengthens the sense of collaboration and shared investment in your success.

- Proactive problem-solving. When faced with a challenge, include your VC partners in the problem-solving process. This collaborative approach not only builds the partnership but also demonstrates your ability to overcome obstacles efficiently.

- Providing value to your VC partners, not just financial rewards. Whether it's connecting them with useful people, sharing industry insights, or actively participating in their network, adding value builds the tie and fosters loyalty.

- Consistent performance & meeting milestones. Strive to achieve and surpass milestones, demonstrating your devotion to keeping promises. Reliable performance boosts confidence and promotes the idea that collaboration is a good investment.

Investor fatigue and oversaturation of fundraising efforts

In today's hyperconnected environment, where startups compete for the attention of a small number of investors, understanding and overcoming this fatigue is critical for entrepreneurs.

Oversaturation in fundraising efforts can have some negative consequences for startups:

- Reduced attention. Investors may feel overwhelmed by a flood of fundraising requests, resulting in shorter attention spans and lower engagement with individual pitches.

- Increased mistrust. A steady influx of fundraising efforts may instill mistrust in investors, prompting them to approach fresh prospects with caution.

- Extended decision-making timelines. Fatigued investors may take longer to make choices, extending the fundraising process for businesses that require urgent cash injections.

Investor fatigue is a reality that most projects in the market have to face. To overcome investor fatigue and gain maximum investor attention over competitive projects, you need to:

- Be honest about your fundraising goals and scheduled milestones. In the current market, it is preferable to raise less to fulfill certain goals rather than a large round to accomplish your entire roadmap.

- Strategic timing. Plan your fundraising efforts to avoid peak periods when investors are swamped with pitches or preoccupied with public events.

- Utilize technology. Use technology to streamline and tailor your outreach campaigns. Implement data-driven techniques to identify the most interested investors for your firm based on open rates, conversion to dialogue, and other campaign metrics.

- Build relationships. Prioritize relationship-building before instant fundraising.

Innovative approaches to engaging investors in changing market conditions

Creative methods not only pique investor interest but also establish your startup as a forward-thinking and adaptive participant in the competitive fundraising landscape.

In a shifting industry, typical pitch tales may not suffice:

- Consider dynamic storytelling. Embrace dynamic storytelling that connects your startup's path to the developing market narrative. Highlight your solution's adaptability, robustness, and ability to solve evolving difficulties. Create a narrative that appeals to investors looking for companies that can handle unpredictability.

- Diversify outreach channels & explore alternatives to email campaigns. Telegram, Twitter, Discord, and other messengers enable direct and real-time contact. Engaging potential investors on these platforms allows for more dynamic interactions, creating a sense of community and immediacy that traditional email campaigns may lack.

- Personalized investor communications. Tailor messages to specific investors. Use individualized emails and messages to provide a direct and tailored approach. Having a comprehensive understanding of each investor's interests increases your chances of gaining their attention in a congested fundraising landscape.

- Investors seek data-driven insights to make informed decisions in shifting market situations. Provide clear and informative data on your startup's performance, user engagement, and market traction. Use analytics to demonstrate the concrete impact of your product, instilling trust in investors who value evidence-based narratives.

- A collaborative approach involves forming strategic connections with companies that may share fundraising experience. After industry professionals fine-tune your outreach effort, you could save some time and go deeper into the product.

Conclusion

Startups can establish strong and durable fundraising strategies by combining an understanding of investment best practices with examining economic trends, industry-specific developments, and other external factors.

This study emphasizes the significance of data-driven decision-making, agility, and a multifaceted strategy for acquiring venture investment. It emphasizes the importance of continuous adaptability, innovation, and an investor-centric approach for successfully navigating the complexity of the venture capital ecosystem.

Comments ()