TON Blockchain Review

Introduction

In the ever-evolving landscape of blockchain technology, TON Blockchain has emerged as a compelling force, captivating the attention of developers and businesses alike. Renowned for its advanced features and potential impact on decentralized applications, TON stands as a pivotal player in the evolving blockchain ecosystem.

This study is based on statistics that emphasize the importance of TON: it boasts a truly massive transaction volume per second (currently 104,715 TPS with just 256 validators) that sets it apart from all other blockchains and an enormous potential user base from Telegram messenger (800 million MAU). Are these facts enough to pick TON as the basis for your project right now? In this article, we will try to provide an unbiased and thorough analysis of TON, refraining from the typical promotional tone often inherent in such reviews. Our goal is to present an in-depth evaluation, allowing readers to form their conclusions based on facts rather than subjective endorsement.

We will thoroughly analyze TON's current statistical indicators. In addition, we will examine the broader TON ecosystem, paying attention to developer support, community dynamics, and current projects. Through an analysis of pros and cons, we aim to help readers make an informed decision about whether TON is right for their needs.

Summary

In the realm of blockchain technology, The Open Network (TON) has emerged as a compelling force with its advanced features and potential impact on decentralized applications. This article delves into a comprehensive analysis of TON, covering its history, blockchain components, features, smart contract capabilities, recent incidents, support and documentation, and token supply. Furthermore, it provides an in-depth comparison with Ethereum and Solana, scrutinizing various metrics such as blockchain performance, market conditions, and decentralization.

Key Takeaways

- TON known for groundbreaking speed and scalable architecture

- Support and documentation provided by TON cover a broad variety of topics for participating in an ecosystem activity

- TON faces challenges with a low number of validators

- A significant number of concentration of tokens among a limited number of addresses raises concerns about achieving true decentralization

- The disruption caused by Chinese miners in 4Q2023 has exposed vulnerabilities of TON and raised questions about network resilience

- Ongoing developments and community efforts will play a crucial role in shaping its future

- TON has the potential to be a key player in the blockchain space

What is The Open Network (TON)

History of TON

In 2018, Telegram issued a "lite paper" and a white paper for the Telegram Open Network, initially named Gram. Active development continued until 2020, and during this time Telegram raised funds through private sales of Gram tokens. In April 2018, Gram set a record as the second-largest token sale, raising $1.7 billion, with subsequent billion-dollar sales to global companies after gaining publicity.

Increased attention to Gram led to challenges, including pre-ICO scams on Twitter. Telegram's CEO, Pavel Durov, announced an official ICO participation method to address these issues.

Initially attempting public sales under U.S. jurisdiction, Telegram adhered to SEC regulations. The purchase agreement aimed to provide tokens upon TON's launch to avoid the SEC's classification as securities. However, the SEC considered initial investors as underwriters, viewing Telegram's Gram offering as an unregistered distribution of securities.

Despite Telegram's legal battle with the SEC, it lost the case in May 2020. Founder Pavel Durov halted Telegram's involvement in blockchain development, initiating refunds to initial investors. TON had a dedicated following, and the global crypto community saw its potential. As an open-source project on GitHub, community developers could continue TON's development.

TON Developers aim for Toncoin's mainstream adoption, facilitated by an engaged Telegrams’ enormous user base, simple interfaces, remarkable speed, and overall scalability.

TON Blockchain components

Through smart contracts and a self-healing vertical blockchain mechanism, TON enhances transaction speed, making it self-contained, swift, and scalable. The TON blockchain operates on a heterogeneous multi-chain architecture with Turing-complete smart contracts, allowing the system to solve computations and comprehend agreements. The multi-chain structure enhances network throughput and interoperability, comprising of:

- Masterchain: Encompassing protocol rules, including validator sets and shard distribution.

- Workchain: Handling transactions in smart contracts, with heterogeneous chains having distinct rules for crypto, address formats, and virtual machines.

- Shardchains: Horizontal blockchains are divided into 260 homogeneous chains, each serving a specific purpose.

- Shards: Elements completing the shardchain, comprising blocks that may differ, allowing targeted correction in case of blockchain issues.

TON's notable advantage lies in its flexible architecture, designed for efficiency and scalability. This architecture allows TON to validate and theoretically process millions of transactions per second, ensuring continuous growth without performance loss.

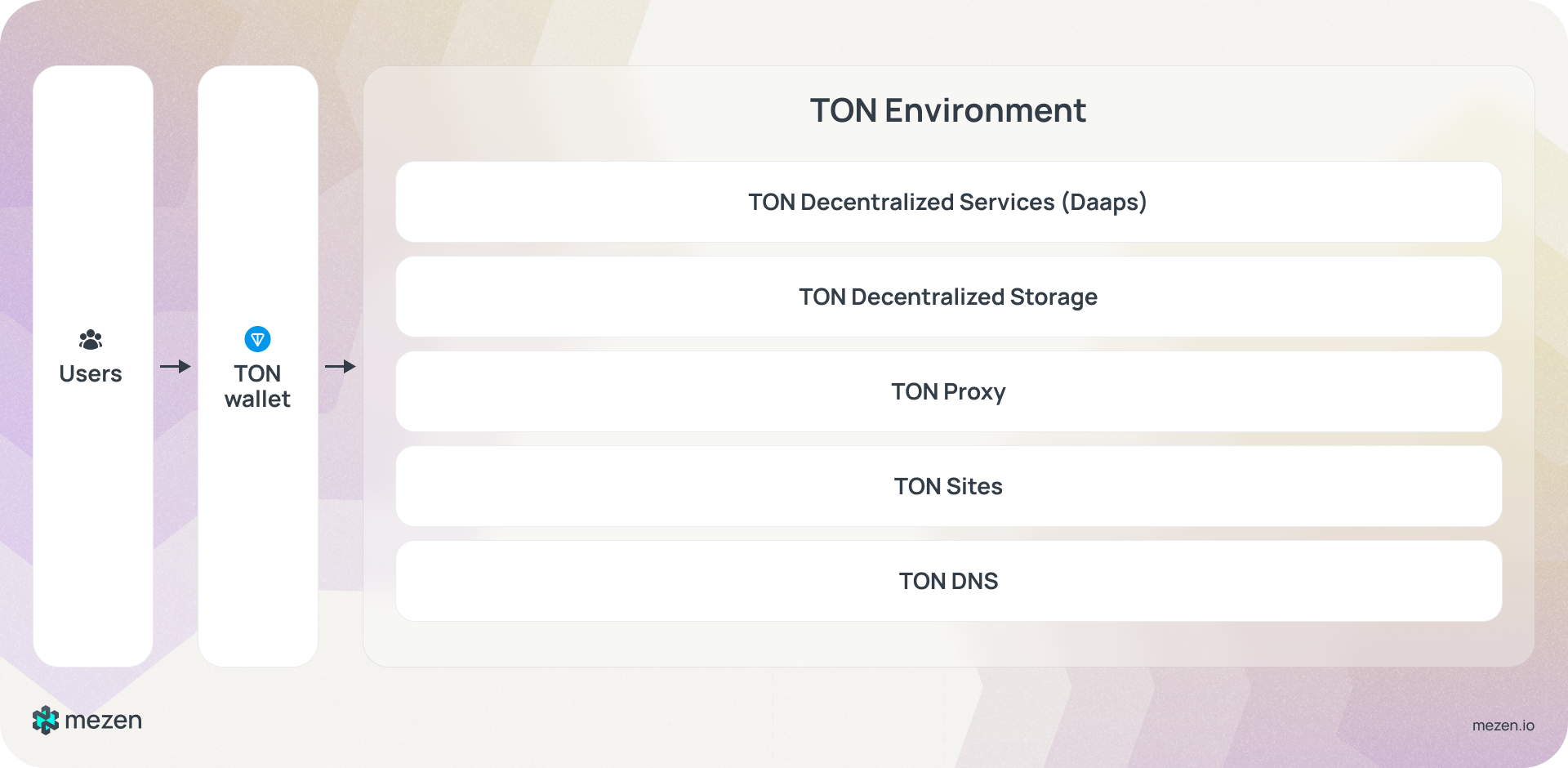

Elements of TON Environment

TON Decentralized Services

The TON team continually improves its services, offering features like a stable architecture, integrated formatted data, and improved network operations. TON innovatively combines Sites and DNS, allowing the launch of decentralized websites without an ”administrator” or fixed IP.

TON Wallets

With 800 million potential global monthly users, TON Foundation provides a wallet for seamless fund transfers, fostering user interaction inside the Telegram App using the bot @wallet. Other popular solutions, such as Tonkeeper, Tonhub, etc. are also available.

TON Decentralized Storage

TON Storage prioritizes private encryption for secure private keys, utilizing smart contracts for financial incentives. Anyone can be a node operator, receiving payments and contributing to the decentralized storage network.

TON Proxy and TON Sites

TON Proxy serves as an anonymity layer, enabling decentralized VPN services and concealing network identity and IP addresses. This ensures that high-stake validator nodes maintain anonymity. When integrated with the P2P layer and TON DNS, TON Proxy provides censorship immunity.

TON DNS

TON offers user-friendly domain names for accessible smart contracts, crypto wallets, and accounts. Businesses can now purchase domains using Toncoin. These decentralized domains are immutable and transparent, simplifying interactions.

TON Main Features

The TON blockchain shares common use cases with other networks, including payment for decentralized data storage, dApps, validator rewards, and on-chain governance voting. To enable diverse applications, the network incorporates the following features:

Layer-1: Operating on Proof-of-Stake (POS) consensus, Layer-1 serves as the base blockchain, acting as the source of truth for transaction settlement.

Toncoin: TON introduces Toncoin as its native token, accessible through custodial or non-custodial TON wallets. The coin facilitates transactions, gaming, network operations, and collectibles.

Shardable: TON accelerates transactions by implementing sharding, dividing the network into smaller networks to prevent the accumulation of unverified blocks and reduce the workload.

Self-recovery mechanism: TON features a self-recovery mechanism, enabling network continuity without hard forks, and allowing the creation of new blocks without unwanted network splits.

Smart contracts: Unlike Ethereum, the smart contract code on TON is not immutable and can be easily modified. TON's smart contracts are built on the Actor Model, extending smart contract capabilities even to wallets.

Smart Contract Capabilities

TON blockchain provides its developers and users with a big space for creativity with smart contracts. Smart contracts are operating on TON Blockchain, specifically on its TVM (TON Virtual Machine). Unlike Ethereum and other blockchains, with smart contracts, TON has unique capabilities and features.

Smart contract capabilities of the TON blockchain include:

- Modifiability: In contrast to some other blockchain platforms, TON allows for the modification of smart contract code. This means that developers can update and improve their smart contracts without requiring a completely new deployment. This feature offers flexibility and adaptability to changing requirements or security concerns.

- Actor Model: TON's smart contracts are built based on the Actor Model, a mathematical model for concurrent computation. The Actor Model allows for the creation of independent actors who can interact with each other through message passing. This model provides a structured way for smart contracts to communicate and execute tasks.

- Integrated Wallet Features: TON extends smart contract capabilities even to wallets. This integration enables wallet functionalities to be implemented as smart contracts on the TON blockchain. Users can access a variety of features, such as token transfers and other financial operations, directly within their wallets.

- Account abstraction: This critical technology for mass adoption of cryptocurrency among people is already included in TON “by design”, unlike other blockchains (i.e. Ethereum). Every wallet in The Open Network is a smart contract that opens broad opportunities for developers and users.

Scalability and Throughput

At the end of 2023, in a highly successful live-streamed stress test, the TON Blockchain definitively established itself as the world's fastest and most scalable blockchain. Throughout this test, the TON testnet was initiated with 256 validators. Under substantial load, the testnet expanded to 512 shards, enabling the network to achieve an impressive 104,715 transactions per second (TPS). The remarkable success of this test unequivocally demonstrates TON's capability to serve as the foundational layer for the Web3 ecosystem in Telegram, cater to large enterprises developing blockchain-based products, and function as a global decentralized network poised to surpass traditional finance rails.

“The most amazing thing is that, despite the record-breaking results, the speed reached is not the limit of what TON is capable of. With a sufficient number of validators, TON’s unique architecture allows the blockchain to scale almost infinitely and process millions of TPS from billions of users. We are pleased to show you in practice that, with only 256 cloud validators, the TON blockchain broke the world speed record.” said Anatolii Makosov, Core Development Lead at TON Foundation.

The test data has been validated by CertiK, The Open Network's security partner and a Web3 smart contract auditor. CertiK, known for its comprehensive tools for industry-scale security, conducted formal verifications of the TON blockchain to ensure stability and security. It also collaborated with the TON Foundation in verifying network speeds. The live-streamed stress test, hosted on Alibaba Cloud infrastructure, involved extensive verification and performance monitoring.

CertiK verified the network's architecture, ensuring the 256 validators operated as intended and were configured correctly. The uniformity of software versions across nodes was also confirmed. In the performance test, TON lite servers fetched transaction counts at one-minute intervals to calculate transactions per second (TPS).

TON's unique architecture inherently ensures scalability. Employing an "infinite sharding paradigm," TON forms a blockchain of blockchains, capable of splitting into 2^30 workchains, each subdivided into up to 2^60 shards. Unlike maintaining constant capacity, TON dynamically scales based on demand, optimizing computational efficiency. TON achieves its high scalability and throughput by dynamic sharding the blockchain into multiple shards or shardchains, each of which can process transactions independently and in parallel. Sharding splits the blockchain state into smaller pieces so that each set of nodes only needs to store and validate a subset of the data.

Recent Incident

Commencing with the widespread acknowledgment of TON as the world's fastest blockchain, a subsequent event severely impacted its reputation. The acclaimed 100,000 transactions per second (TPS) plummeted to merely 1 TPS, causing a notable setback of 2.5 million transactions in three days, effectively halting the blockchain's functionality.

The catalyst for this disruption was attributed to Chinese miners engaged in mining ton-20, flooding the network with millions of transactions directed at a single address. This unexpected surge exposed a critical limitation in the TON code – a lack of provision for network scalability, thereby revealing a vulnerability that had not been anticipated.

In an effort to mitigate Chinese involvement in the blockchain, development teams collaborating with the TON Foundation opt for a strategic measure. They collectively decide to disable all wallets and prevent the generation of new transactions on the blockchain.

However, someone called Peskar wrote a code to mine ton-20 and transactions started again. TON Foundation decided to remove config from ton.org but Peskar had a copy, which he published in his channel and transactions continued attacking the zero address. After this “fight” between TON Foundation and 14-year-old talent, TON Foundation tried to find this boy and paid him a good amount of USDT. Lately, Peskar deleted all posts with this code from his channel.

Then TON Foundation suggested that everyone they knew shut down all the nodes (servers) so that no one would be able to receive transactions. After a couple of hours, they shut down 80% of them, but there were still some servers whose owners they didn't know. TON Foundation decided to DDOS these servers so that new transactions would not be accepted. To stop the Chinese, the TON Foundation gave 2 large grants to the ton-20 team, for their contribution to blockchain development and they in turn stopped sending millions of transactions.

TON Foundation issued a report where they called this technical incident because of the poor quality of validators’ hardware. They also urged everyone to update their hardware. Lately, all validators made their updates, and transactions started to gradually go through and in just 22 hours all 2.5 million had been processed.

Support & Documentation

In the dynamic landscape of blockchain technology, the quality of support and documentation provided by a platform is often indicative of its commitment to user accessibility, transparency, and overall ecosystem health. A comprehensive analysis of the support and documentation within the Telegram Open Network (TON) reveals key insights into the user experience and the platform's facilitation of developer engagement.

Support Channels: TON's support infrastructure encompasses various channels, such as Telegram groups and community forums. These platforms serve as hubs for user interactions, allowing individuals to seek assistance, share insights, and troubleshoot issues collaboratively. Analyzing the responsiveness and effectiveness of these support channels provides valuable insights into the community's vibrancy and the platform's commitment to decentralized problem-solving.

Documentation Depth and Breadth: The depth and breadth of official documentation play a pivotal role in users' ability to understand and navigate the intricacies of the TON ecosystem. TON official documentation covers a variety of topics, from concepts of The Open Network and other onboarding materials to guides for smart contracts, nodes, etc. Smart contracts on TON execute in TVM (the stack-based TON Virtual Machine). TON’s smart contracts are programmed mainly on the FunC Language, which is statically typed as C (it’s also possible to use Tact and Fift). On the official website, developers can find all the necessary information to understand and program smart contracts on TON. It covers FunC description, tutorials, and best practices, and explains wallets, TVM, and data formats.

TON in Numbers

In this section, we are going to compare TON with its main competitors, successful Layer 1 blockchains, in different fields: blockchain performance, and market maturity.

Blockchain Performance

- Block and Finalization Time

Block time and time-to-finality are crucial metrics for transaction speeds in consumer products. Faster block generation reduces the waiting time for money transfers or smart contract execution.

TON

TON generates a new block on each shardchain and the masterchain roughly every 5 seconds. Simultaneously, new blocks on all shardchains are created, with the masterchain block generated about one second later to include the latest shardchain block hashes. However simple action on TON is a minimum 5 transactions, so it’s important to note that when developing a product on this blockchain.

Ethereum

Ethereum operates with slots and epochs. A slot is a 12-second period where a new Beacon Chain and shardchain block can be proposed. An epoch consists of 32 slots (6.4 minutes). Block finality requires at least 2 epochs, resulting in a time-to-finality of at least 12.8 minutes.

Solana

Solana claims to generate one block every second but has an extended block finalization time. Finalization occurs after 16 voting rounds, each lasting approximately 400 milliseconds, resulting in a time-to-finality of 6.4 seconds.

- Performance

Blockchain performance is crucial for complex blockchain products like DeFi, GameFi, and DAOs.

TON

TON is a Turing-complete and high-performance blockchain capable of handling any transaction complexity on its masterchain and workchains.

Ethereum

Ethereum's Turing-complete EVM is limited to the Beacon Chain, with a network limit of 15 transactions per second. The lack of cross-shard interactions limits execution in a decentralized environment.

Solana

Solana is Turing-complete but excels with simple transactions of predefined types. Performance issues may arise when data exceeds RAM capacity.

- Scalability

Scalability correlates with user quantity and interactions.

TON

TON supports workchains and dynamic sharding, accommodating up to 232 workchains subdivided into up to 260 shardchains, enabling near-instant cross-shard and cross-chain communication, achieving millions of transactions per second.

Ethereum

Ethereum supports up to 64 shardchains and the Beacon Chain, with unclear capabilities and potential delays in cross-shard interactions.

Solana

Solana lacks sharding and workchain support.

Market condition

- Token Supply

Native token is a blood cells of any Blockchain. Its supply and mechanics are important aspects of being the ultimate solution for mass adoption.

TON

TON, the native cryptocurrency of The Open Network, has no supply cap of Toncoin. Currently, the total supply is 5.1b TON. It also has a deflationary mechanism to burn 50% of all transaction fees, including transaction and storage fees, decreasing the circulating supply.

Ethereum

Ethereum's native cryptocurrency is Ether (ETH). Ethereum does not have a fixed supply. The total supply of Ether is determined by a mechanism called the "block reward," where new ETH is issued to miners for validating transactions and adding blocks to the blockchain. Ethereum has a deflationary (burning) mechanism. With the EIP 1559 upgrade, users pay a base fee and a tip. The network burns all base fees, while miners receive the tip as a reward.

Solana

Solana's native token is SOL. Similar to Ethereum, Solana does not have a capped total supply. The circulating supply of SOL represents the tokens actively trading in the market, which is currently 429 mln. Solana has implemented mechanisms to address 50% of token burning, primarily through transaction fees and network-related activities. The burned tokens on Solana are a result of various operations, contributing to the reduction of the overall token supply.

- Blockchain activity

Native token is a blood cells of any Blockchain. Its supply and mechanics are important aspects of being the ultimate solution for mass adoption.

TON

At the moment, market activity on the blockchain remains at an early stage. The number of protocols is at an extremely low level relative to the main competitors Ethereum and Solana. High capitalization (about $8 billion) does not correlate with the volume of TVL. The ratio MarketCap/TVL is just over 606, which is 20 times higher than Solana and 60 times higher than Ethereum, making TON market capitalization overvalued in terms of market demand. In addition to that the current state of stablecoins in the TON ecosystem is primarily dependent on bridged assets, with no native decentralized stablecoins available.

Ethereum

Ethereum, the pioneer in smart contract platforms, continues to be a bustling hub of blockchain activity. With a Total Value Locked (TVL) in decentralized finance (DeFi) protocols of almost $30 billion, Ethereum maintains its dominance in the decentralized ecosystem. The Ethereum blockchain hosts almost a thousand of decentralized applications (DApps) and protocols, with a robust trading volume on decentralized exchanges (DEXs). Additionally, Ethereum is home to a significant portion of the market's stablecoins, contributing to its overall market cap.

Solana

Solana, known for its high throughput and low transaction fees, has witnessed a surge in blockchain activity. The Total Value Locked (TVL) in Solana's DeFi protocols has grown substantially to over $1.1 billion, reflecting the network's increasing adoption. Solana boasts a dynamic ecosystem with 120 protocols and decentralized applications, attracting users with its speed and efficiency. The trading volume on Solana-based decentralized exchanges has seen notable traction, recently in December 2023 even surpassed Ethereum in Trading Volume in 24h on DEXs. While the market cap of stablecoins on Solana is not as extensive as Ethereum, the network's rise in prominence indicates growing stability and utility.

TON Centralization

Developers look at 3 important characteristics while creating a new Layer1 blockchain: scalability, security, and decentralization of the blockchain. The simplicity of the choice is made difficult by the fact that you can only choose 2 of the 3 characteristics. It's almost a law, which has been proven by practice. Let’s look at Ethereum. Security – YES. One of the most secure blockchains on the market. Decentralized – YES. Ethereum operates on a peer-to-peer network of nodes that collectively validate and store transactions. Scalability – NO. Ethereum gas fees are high, especially in times when the network is experiencing a high load, which limits the scalability of the Ethereum blockchain. Other cases are Solana, Binance Smartchain (BSC), TRON, and others. They’re secured, and scalable, but centralized.

What about TON? Is it secured – YES. Is it scalable – definitely YES. What about decentralization? Seems to be not.

TON aimed to achieve decentralization through the distribution of nodes across the network. The TON blockchain was designed to operate on a Proof of Stake (PoS) consensus mechanism, where validators (nodes) are chosen based on the amount of cryptocurrency they "stake" as collateral. This approach intended to prevent centralization by reducing the influence of a few large stakeholders.

Nodes:

The TON network consisted of various types of nodes responsible for different functions:

- Full Node

Full nodes store the entire history of the TON blockchain and validate transactions. They contribute to the network's security and decentralization by distributing the load of maintaining the blockchain. - Validator Node

These nodes play a crucial role in validating transactions and creating new blocks. Validators are selected based on the amount of cryptocurrency they commit as collateral. - Full Node + Liteserver

When a full node activates an endpoint, it takes on the role of a Liteserver, allowing it to handle requests from Lite Clients and interact with the TON Blockchain seamlessly. - Archive Node

An Archive Node fundamentally encompasses the functionalities of a full node, with the added capability of archiving the complete block history.

Currently, The Open Network has 291 validators, staking 207 million TON in total. The biggest validator has a 2.96% share of the total pool. Ethereum has 1.1 million validators. Solana has 2,014 validators in total. Among these 3 networks, TON has the lowest amount of validators. The ratio of Market Cap (in $ mln) to Validators is the following:

- TON: 26.8

- ETH: $258*10^{-6}$

- SOL: 2.3.

These ratios lead us to the conclusion that TON’s aim to achieve decentralization hasn’t been achieved yet. Also, we should bear in mind, that the number of validators depends on Blockchain activity which is extremely low at this point on TON.

Token Distribution

Another fact that does not yet allow us to call TON a decentralized blockchain is Token distribution. A brief excursion into history. In May 2020 Telegram suspended active participation in the development of the network due to disagreements with the U.S. SEC. Later Telegram team decided to distribute test Gram tokens via the token mining process.

Telegram launched token mining on July 6, 2020, by transferring tokens from the system address to 20 contracts that distributed coins.

Contract addresses were of two types: Small Givers and Large Givers. The second distributed more coins (100,000 instead of 100 each time) but required more computing power.

Mining continued from July 6, 2020, to June 28, 2022, but almost all token emissions were distributed during the first 51 days:

- From July 6 to August 26, 2020, Large Givers distributed 4.8bln (96%) tokens

- Small givers gave away 9.9 mln tokens (0.2%);

- From August 27, 2020, to June 28, 2022, Small Givers distributed 117.3 mln tokens (2.35%).

The remaining 1.45% of the total distribution occurred in 2019–2020 from the system address for testing purposes. The majority (25 mln) of these funds were subsequently transferred to one of the TON Foundation addresses, accessible here.

Since the conclusion of mining, the test Gram tokens were rebranded as mainnet TON tokens, experiencing a remarkable growth in their Fully Diluted Market Capitalization from 0 to $8 billion over three years. The majority of tokens are still held by major holders, particularly the Large Givers miners from 2020.

Mining engaged 3,278 unique addresses, but the emphasis will be on the 248 addresses involved in the Large Givers distribution, responsible for 96% of the TON allocation, which is strongly connected (see more on-chain analysis).

Conclusion

TON, known for its groundbreaking transaction speed and scalable architecture, showcases its prowess in the blockchain space. However, recent incidents, particularly the disruption caused by Chinese miners, have exposed vulnerabilities and raised questions about the network's resilience. The support and documentation provided by TON are vital for user accessibility and developer engagement, but ongoing efforts are needed to enhance these aspects.

In terms of decentralization, TON faces challenges, especially with a comparatively lower number of validators and a significant concentration of tokens among a limited number of addresses. This raises concerns about the network's ability to achieve a truly decentralized status.

As we compare TON with Ethereum and Solana, each platform exhibits unique strengths and weaknesses. TON's high transaction speed and ambitious goals are counterbalanced by recent incidents and concerns about decentralization. Ethereum's established presence and extensive ecosystem, particularly in DeFi, are commendable, but scalability remains a challenge. Solana, with its impressive throughput and growing ecosystem, stands out but faces its own set of issues.

Ultimately, the choice between these platforms depends on specific project requirements, balancing factors like speed, security, decentralization, and community support. TON has the potential to be a key player in the blockchain space, but ongoing developments and community efforts will play a crucial role in shaping its future.

The research has been prepared by:

Sources

- https://aquaprotocolxyz.medium.com/the-future-of-stablecoins-on-ton-bridged-decentralized-or-both-30f52ca01031

- https://learn.bybit.com/blockchain/what-is-toncoin-ton/

- https://www.zeeve.io/blog/unlocking-the-potential-of-ton-blockchain-a-comprehensive-guide/https://www.gemini.com/cryptopedia/wton-wrapped-ton-crypto-wrapped-token#section-the-open-network-intro-to-the-ton-crypto-ecosystem

- https://ton.org/en/analysis

- https://ton.org/comparison_of_blockchains.pdf

- https://www.tonstat.com/

- https://docs.ton.org/develop/smart-contracts

- https://ton-community.github.io/tutorials/02-contract/

- https://finance.yahoo.com/news/open-network-ton-proves-world-180425308.html?guccounter=1&guce_referrer=aHR0cHM6Ly93d3cuZ29vZ2xlLmNvbS8&guce_referrer_sig=AQAAAHx1jfSunFcMm7pCaXt2L16CExo_nuofXGku7BQKRUGJZp-cEu1D2KBlO6NfxJ11Dta7yZrIqyBfa80PtSbMi1LlkMkXdNEuixWhzvoGRYjXi44_SfwRmPHoLDLhX5KDOCdw-7UQ97oEix3rlNenga8ZJIAawVhpw4bWP_o4QLnX

- https://syndika.co/blog/a-comparative-analysis-of-distributed-ledger-technologies-ton-vs-evm-based-blockchains/

- https://ton.org/en/validators

- https://solanabeach.io/validators

- https://beaconscan.com/stat/validator

- https://medium.com/@whiterabbit_hq/ton-blockchain-a-group-of-related-whales-mined-85-of-ton-supply-2e3300cc93bc

- https://decrypt.co/resources/what-is-toncoin-the-cryptocurrency-conceived-by-telegram

- https://telegra.ph/7-Dec-2023-12-07

Comments ()