Tokenomics review: Uniswap

What is tokenomics, and why is it important?

The study of the economic models underlying a cryptocurrency token or other digital asset is known as tokenomics. It includes several elements, such as the overall supply and potential dilution, initial distributions, vesting schedules, utility, burn mechanisms, and stability of the economy.

A project's tokenomics, or face, represents the team's working style, the efficiency of internal procedures, and the project's long-term sustainability. Benchmark-based allocations, well-thought-out token utilities, vesting dates, and a well-written description of all processes and utilities are all crucial components of excellent tokenomics.

A well-designed tokenomics will allow for a tremendous amount of value to be invested in a token that will both keep the platform functioning and ensure investor attention and fundraising.

We will highlight important factors that investors should consider when selecting a project and that teams should concentrate on when creating their tokenomics, using Uniswap's tokenomics as an example.

A brief introduction to the project

Name: Uniswap

Token: UNI

Market cap (10.07.24): $6.1B

Description: Launched in 2018, Uniswap is a decentralized exchange (DEX) built on Ethereum that facilitates automated token swaps via liquidity pools. It allows users to trade ERC-20 tokens without intermediaries using an Automated Market Maker (AMM) model.

Token utility

UNI is an ERC-20 governance token integral to the Uniswap ecosystem. It facilitates decentralized decision-making and incentivizes active community participation. Holders of UNI tokens have the power to propose, discuss, and vote on changes to the Uniswap protocol, ensuring its development aligns with the community's interests.

Governance & voting

The primary function of UNI is to empower its holders with governance rights. Token holders can vote on various proposals related to the protocol's future, including fee structures, upgrades, and usage of the community treasury. This decentralized governance model ensures that the protocol evolves in a way that benefits its users and maintains its decentralized nature.

Security & trust

The UNI token's role as a governance tool builds trust within the Uniswap ecosystem. By giving the community control over important decisions, it mitigates the risks associated with centralized control. The community's ability to propose and vote on changes ensures transparency and accountability, essential components in the decentralized finance space.

Utility & ecosystem participation

While UNI tokens are not directly distributed to liquidity providers as rewards, they play a crucial role in the governance of the Uniswap protocol. UNI holders influence decisions that can impact liquidity provider incentives and overall platform health. The presence of a robust governance token encourages long-term involvement and active participation from the community, ensuring the protocol remains user-focused and adaptable to changing market conditions.

Thus, the main utility of UNI remains its governance function, allowing holders to vote on protocol changes. However, for many investors, this may not be sufficient. UNI token holders do not receive any direct income from the platform's activities, such as trading fees or transaction fees. Unlike some other tokens, UNI does not feature a burn mechanism to reduce the total supply in circulation, which could potentially increase the value of the remaining tokens.

As a result, investors may feel that holding UNI lacks direct financial incentives compared to other tokens that offer staking rewards or profit-sharing mechanisms.

Allocations, vestings, and cliffs

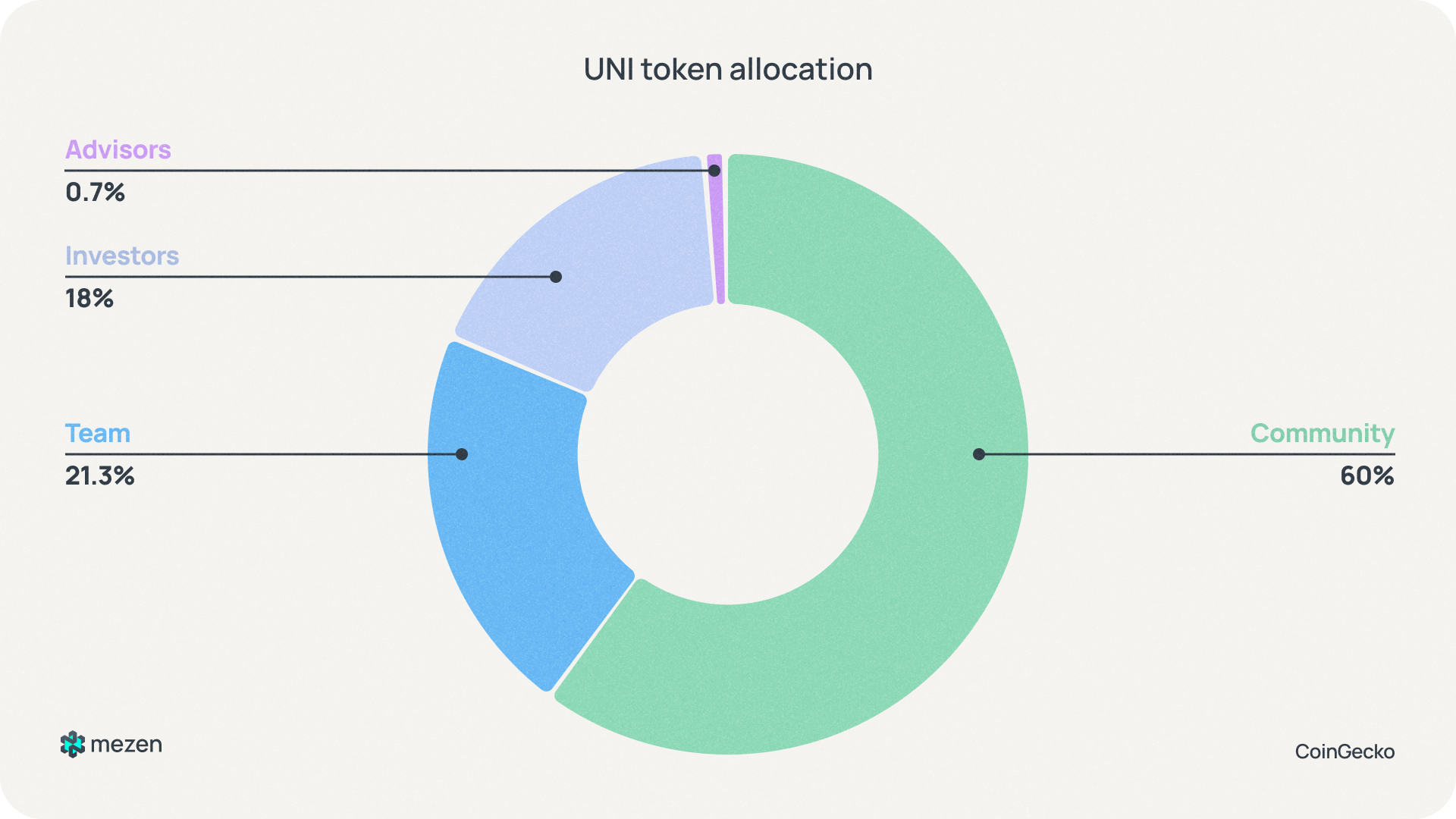

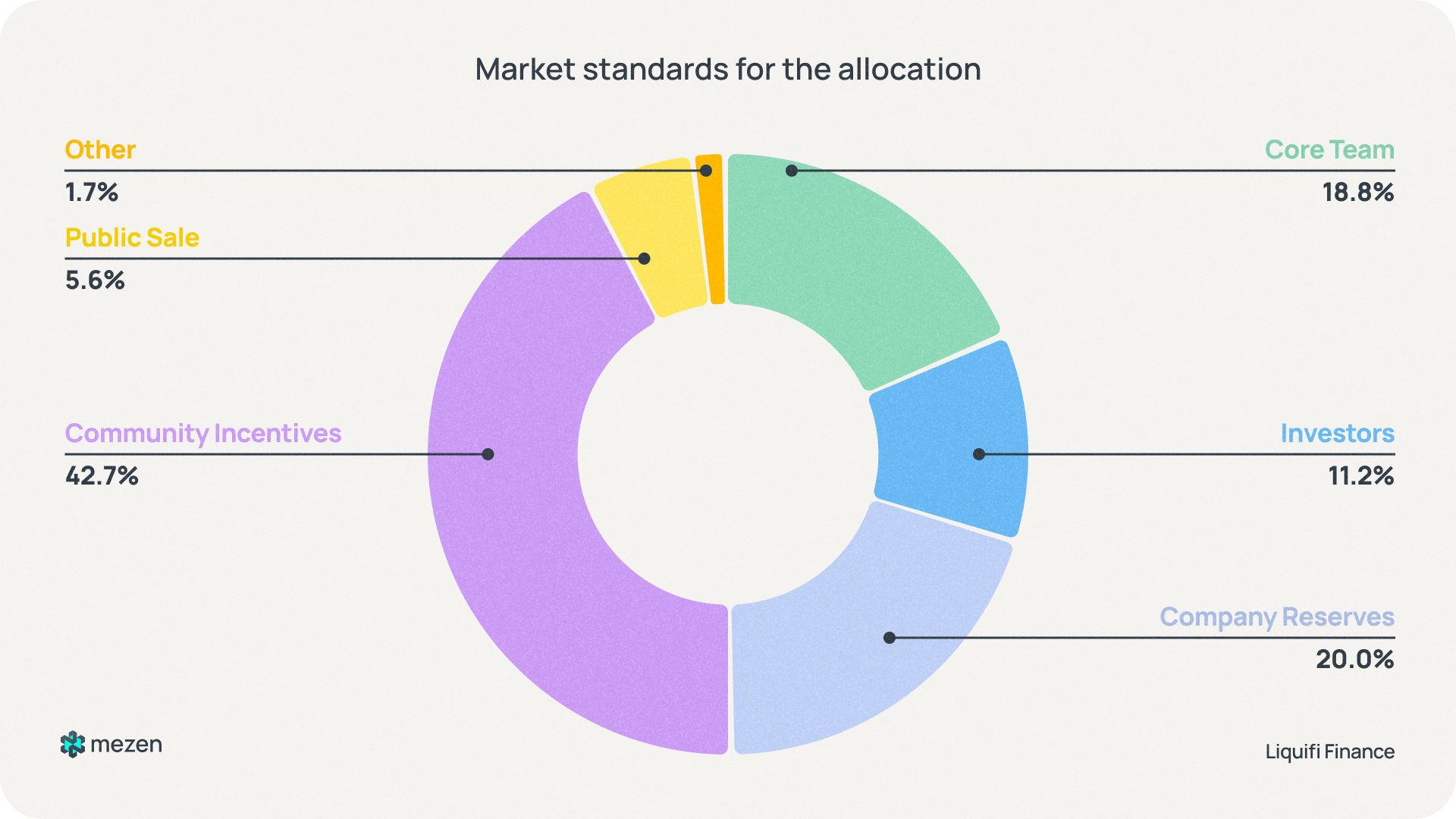

Upon initial inspection, it may appear that the allocation of tokens for the Uniswap project stands in stark contrast to the established industry benchmarks that have emerged in recent years. Specifically, the distribution of the 1,000,000,000 UNI tokens is divided amongst only 4 categories (Figure 1). In contrast to other projects that often have between 5 to 7 categories, Uniswap's allocation is more concentrated among fewer categories, primarily focusing on the community, team, and investors (Figure 2).

Figure 1. UNI token allocation. Source: CoinGecko

Figure 2. Market standards for the allocation. Source: Liquifi Finance

In a general sense, Uniswap's tokenomics categories meet current market averages while showcasing common practices from 2020-2021. Let's look at each category in more detail:

- Community: The share of tokens allocated to the community is 60.0%, which is significantly higher compared to other projects. However, the excess can be attributed to the lack of category splitting into reserves and incentivization.

- Team: The allocation for the team is 21.3%, aligning with market norms, which typically range from 18.0%-22.0%.

- Investors: 18.0% of the tokens are allocated to investors, which is a reasonable allocation to ensure long-term project support.

- Advisors: A small portion, 0.7%, is allocated to advisors, reflecting standard industry practices.

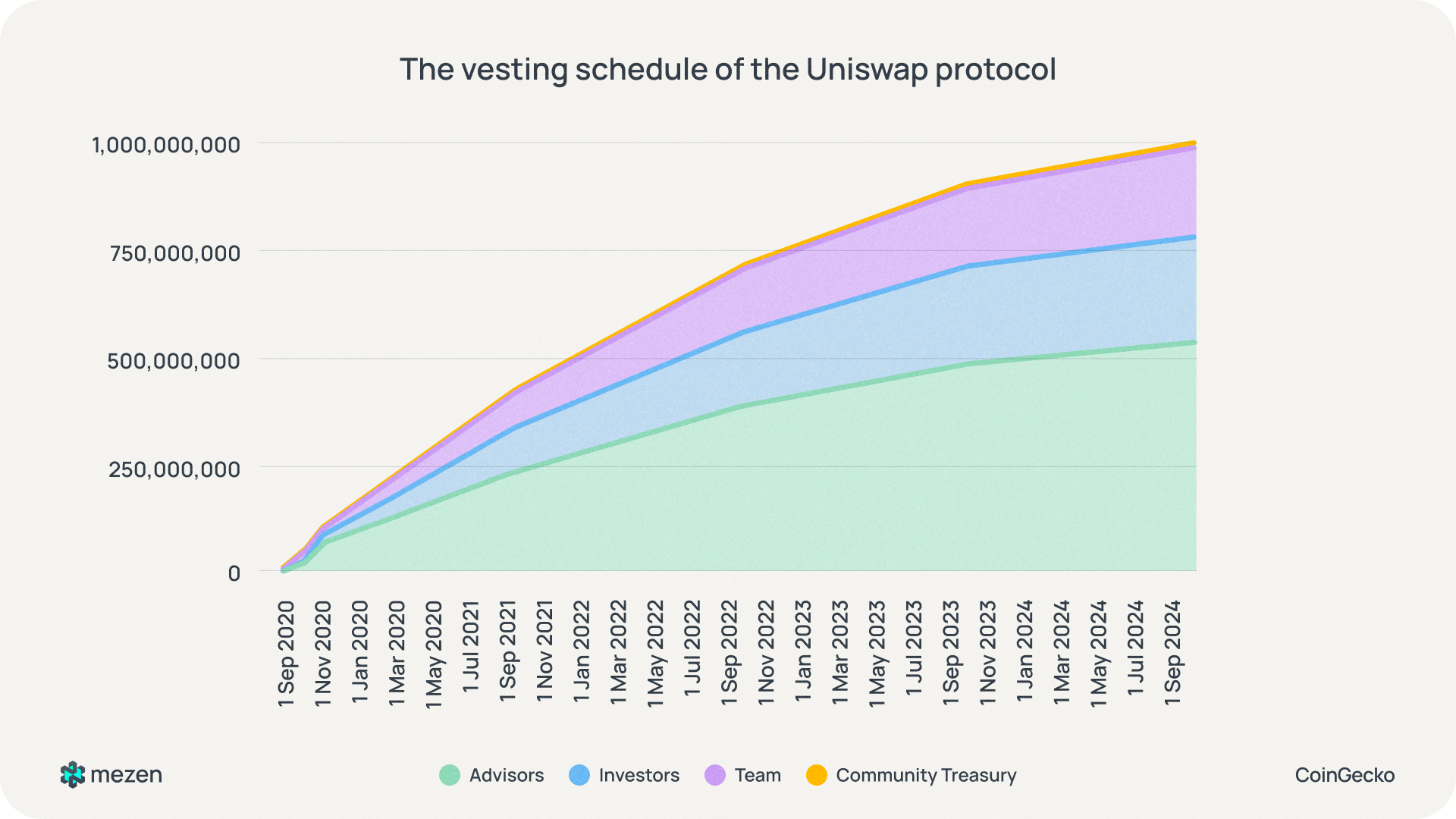

Let’s take a look at the vestings and cliffs (Figure 3).

Figure 3. The vesting schedule of the Uniswap protocol. Source: CoinGecko

The structured vesting schedule highlights that tokens are distributed evenly over time without any abrupt increases. This even distribution is crucial for maintaining token price stability and preventing market shocks. By avoiding large, sudden releases of tokens, Uniswap can mitigate the risk of significant price drops that could result from a large influx of tokens hitting the market simultaneously.

This systematic approach to token release ensures that all stakeholders, including community members, teams, investors, and advisors, receive their tokens gradually. Such a strategy helps maintain investor confidence and promotes a stable, sustainable growth of the Uniswap ecosystem.

However, once the transition process is complete, Uniswap sets an annual inflation rate of 2% to ensure that everyone continues to participate and contribute to the Uniswap protocol. Obviously, the inflation rate has a negative impact on passive Uniswap holders, as there is no limit to its duration.

Overall impression of the whitepaper

The primary goal of the Uniswap whitepaper is to provide detailed and understandable information, enabling investors to form well-informed conclusions about the project. Upon reviewing the entire whitepaper, it is evident that it is well-structured and offers a comprehensive description of processes.

The Uniswap whitepaper is meticulously organized and covers all key aspects of the protocol's operation. It delves into the workflow process and highlights the main instruments used within the protocol, offering a clear and detailed explanation for readers.

Conclusion

The Uniswap tokenomics framework stands out as a robust example that underscores the significant role of the community and stakeholders in the project's success. The UNI token serves as a critical tool for governance, allowing holders to participate in decision-making processes that shape the future of the protocol. While the project's allocations, vesting schedules, and cliffs may seem straightforward, the structured and methodical approach to token distribution has effectively maintained the token's price stability and supported the project's overall development.

The detailed technical descriptions within the whitepaper provide investors with a thorough understanding of the protocol's processes and functions. This comprehensive information empowers investors to make informed decisions regarding their involvement with the Uniswap project. The commitment to transparency and decentralized governance exemplifies Uniswap's dedication to building a sustainable and community-driven ecosystem.

However, it is important to note a significant drawback for investors in Uniswap: the absence of income distribution among investors. This is a serious disadvantage for those seeking more stable cash flows and quick returns. The lack of revenue sharing adds uncertainty regarding future dividends from the project, making it less attractive for investors who prioritize immediate financial benefits or cash flows over governance participation.

Comments ()