Effective pitch strategies for startups

Summary

Crafting a compelling pitch is a critical skill for founders to master in order to get their future unicorns off the ground. There are three key techniques that founders can use to create an engaging pitch and successfully persuade investors:

– Undertake extensive research on possible investors to better understand their priorities, previous investments, and decision criteria. This allows businesses to adjust their pitch material and messaging to each audience's specific needs and interests.

– Represent the essence of the business: in a brief, effective pitch, summarize the core issue, suggested solution, and market potential.

– During the pitch meeting, focus the verbal narrative on real-world challenges that the startup can address for the investors' target industries. Emphasize current traction with tangible data that demonstrate market viability and technological capabilities. Finally, for mutual benefit, integrate future vision statements with investor aspirations.

Adopting these personalised, audience-centric approaches significantly increases the likelihood that startup pitches will receive the funding required to transform visionary ideas into investor-validated firms set for success.

Pitching is vital for startups seeking

funding and growth

In the dynamic realm of startup fundraising, effective pitching stands as the linchpin for securing essential funds and fostering exponential growth. Crafting a pitch is more than just a presentation – it's an art form that captures the spirit of your startup in a concise and persuasive manner. Investors are investing not just in your product or service but also in your vision, team, and potential for long-term success.

Fundraising requires a strategic mindset from founders. Tailoring your proposal to the investor's interests and aligning with industry developments will increase your appeal: it's not just about exhibiting your product; it's also about demonstrating its relevance and scalability in a competitive market.

Remember that a good pitch is assessed not just by the amount raised but also by the relationships established. Each pitch presents an opportunity for you to build relationships, solicit input, and iterate until perfection.

The pitch deck and spoken delivery are crucial for expressing the value of a startup

A painstakingly created pitch deck serves as a visual story, providing an overview of your company's unique selling qualities and growth prospects. It's a dynamic tool that not only grabs your attention but also communicates your vision clearly.

Equally important is the linguistic component. A refined and engaging verbal delivery enriches the narrative by bringing the facts and data to life. The ability to express your startup's story with clarity and excitement is critical.

In essence, the combination of a visually appealing pitch deck and an engaging verbal delivery is the foundation of a successful company presentation.

Effective strategies let startups attract investors in an overcrowded industry

These three steps enable startup founders to understand investor priorities before pitching:

– Examine VC mandates and typical check sizes.

– Analyse previous investments to determine stage preference and industry concentration.

– Study through leading team social networks to determine eligibility for funding.

Such research reveals a potential investor's viewpoint for areas undergoing rapid development. It displays the traction, projections, and leadership teams that persuaded them to team up with entrepreneurs.

Preparation and fit are key to success. Misaligned investor targets squander valuable startup time since votes of confidence must be gained by rejecting skepticism rather than demonstrating affinity.

Tailor the deck and messaging to resonate with this audience

With information on investor sweet spots, founders can adapt decks, messages, and communication tone of voice accordingly. This guarantees that messaging directly engages the audience's interests, rather than general assertions falling flat. When our pitch deck and verbal narratives explain how our vision and metrics achieve the goals that strategic investors desire, we inspire confidence in potential and partnership feasibility. Research-backed resonance encourages lucrative investments, as aligned backers actively support your shared success.

THE DECK

According to the statistics from DocSend, the average time spent reviewing decks is 2 minutes and 30 seconds, and this time keeps shrinking (-12 seconds from 2022 to 2024). Moreover, the difference between successful and unsuccessful decks is just around half a minute. There isn't much time to make a first impression, so make it count.

To become visible and use the short period of attention right, reduce your startup to a compelling one-liner. This immediately communicates the essence of the problem, solution, and 'why now' opportunity.

Based on the DocSend data, the three most-viewed by investors data in pitch decks are:

- Product

- Business model

- Purpose of the business

Setting the hook with simple notions on these points allows investors to quickly comprehend the bigger picture and understand why you are building this company. It prepares them to receive the subsequent detail-oriented evidence via a properly framed lens.

Outline current traction and measurable results. Persuasive arguments demonstrate actual traction-building ability. Investors deploy resources to accelerate momentum rather than explore unexplored opportunities. Concrete outcomes demonstrate feasibility to investors, who may be dubious based on previous experience. Traction demonstrates focus when output and metrics are more important than elegant decks loaded just with hypotheses.

Even early-stage firms have milestones to share, such as user acquisition, revenue, partnerships, and talent recruitment. Founders should highlight evidence that shows operational progress towards the stated vision. Past performance better predicts future profits.

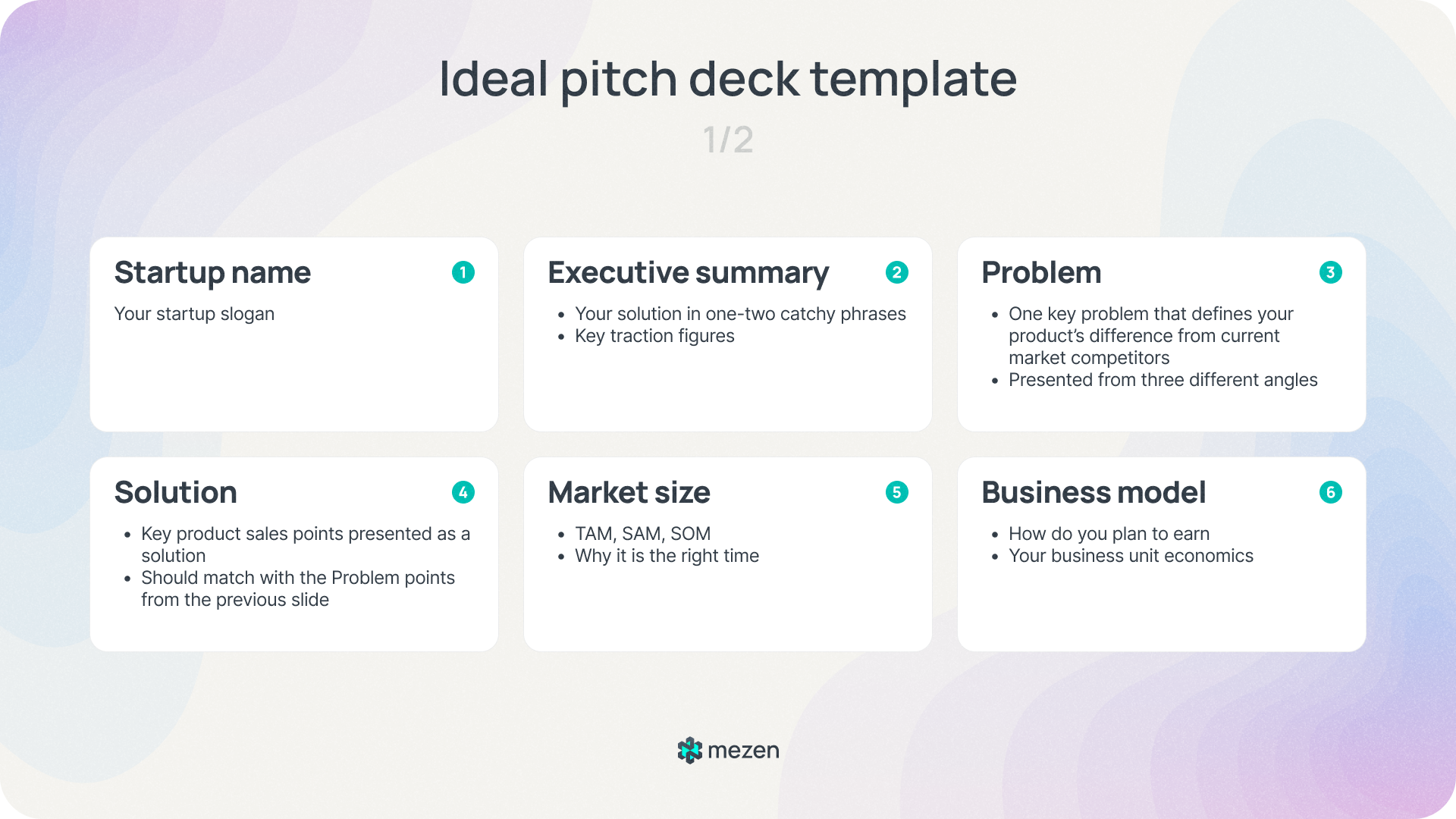

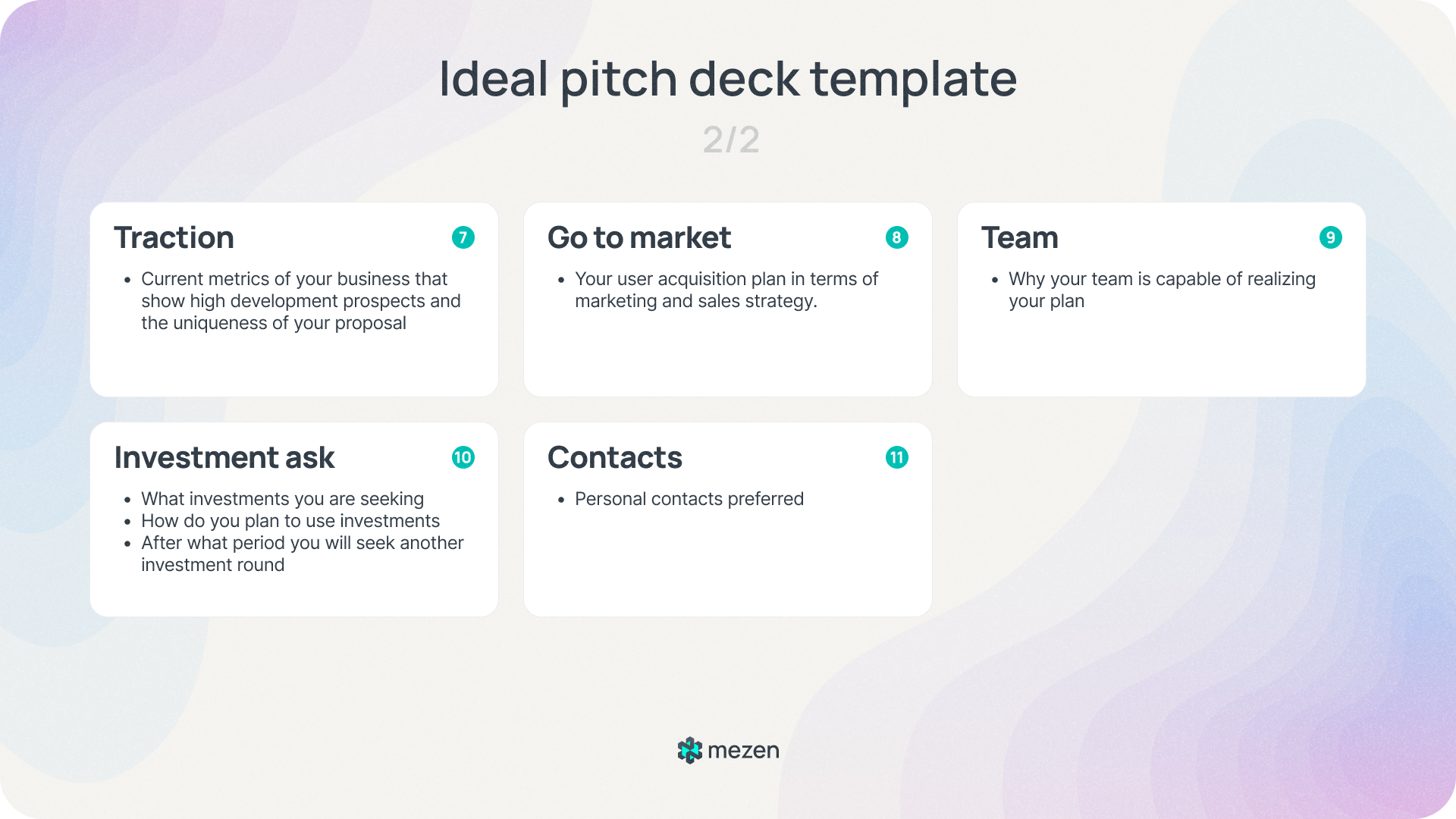

Scheme of an ideal pitch deck

Storytelling instead of selling

When pitching to investors, presenting a story rather than selling is an effective way to engage and fascinate your audience. Rather than blasting investors with a laundry list of features and stats, storytelling helps you build a narrative that conveys the essence and potential effect of your enterprise.

Shape the language of the story with the audience's priorities in mind

Investor-friendly narratives demonstrate how our success corresponds to the goals they want. Communicating in these terms garners attention and respect. It indicates a shared purpose beyond financial gain.

Highlight how the startup tackles real-world problems

Successful entrepreneurs highlight genuine frustrations ripe for change. They understand that investor conviction is based on tangible demands that are ready to drive adoption. As a result, the most captivating pitches focus on relevant problems that can be solved with technology. It fuels investor imagination with future outlooks that are only possible thanks to your team's groundbreaking invention.

Anticipate the pain points that investors will raise

Anticipate investor critiques preemptively. Knowing frequent objections ahead of time allows teams to fine-tune rebuttals that showcase strengths as advantages rather than reflexively discarding difficult questions. The willingness to investigate systemic flaws also increases credibility for transparency and poise. Thoughtful responses then refocus talks on accomplishments. This is antifragility in progress, with investor scrutiny sharpening remedies.

Admit your weaknesses honestly, but reframe them as possibilities

Be open about the inherent weaknesses, tradeoffs, and unknowns. Rather than avoiding difficult topics, demonstrate accountability by confronting improvements head-on. Investors ultimately want to support teams that strive for greater success through flexibility rather than chasing illusions. Conceding weaknesses fosters trust in the ability to work on improvement.

Articulating future vision aligned with investor goals

Express your goal in a language that resonates with the people you invite to join on the trip. Our visions stand up to scrutiny when presented in language that reinforces synergy between financial backers and the mission itself. The founder must demonstrate how his accomplishment reflect supporter values.

Conclusion

In the end, blanket-messaging generic decks fail to connect company missions with investor priorities. Tailoring our communication of problems, traction, team, and ambition to match researched fund mandates pays off. The findings reveal that differentiated, tailored positioning converts at exponentially higher rates than isolated boasting about product attributes alone. Conviction stems from resonance.

Perspective-taking remains integral, not additive. Founders who understand how their firm meets investor goals are best positioned for game-changing funding. Prioritizing audience connection leads to paradigm shifts that address societal requirements. When pitched missions intersect with supporting attitudes, transformation occurs naturally. The benefits of strategic resonance continue to affect the future.

The research has been prepared by:

Comments ()