Tokenomics review: Immutable

What is tokenomics, and why is it important?

Tokenomics is the study of the economic models behind a cryptocurrency token or crypto asset. It encompasses several factors, including total supply and future dilution, initial allocations, vesting periods, utility, burn mechanisms, and economic stability. Good tokenomics is the face of a project, it reflects how the team operates, the effectiveness of internal processes, and the long-term viability of the project. Important aspects of good tokenomics include an interesting and well-thought-out token utility, benchmark-based allocations, and vesting schedules, as well as a well-written description of all processes and utilities. Using an example of Immutable's tokenomics, we will highlight key aspects that investors should consider when choosing a project and that teams should focus on when developing their own tokenomics.

A brief introduction to the project

Name: Immutable

Token: IMX

Market cap (22.02.24): $4.7B

Description: Immutable positions itself as the first layer-two scaling solution for NFTs on Ethereum. It offers instant trade confirmation and near-zero gas fees for minting and trading NFTs. Users can easily create and trade NFTs without compromising the security of their assets.

Why is Immutable tokenomics considered high-quality?

- Useful token utilities. The IMX token has three main utilities – fee payment, staking, and governance. The protocol has fees for selling and buying NFTs, and 20% of the total fee has to be paid in IMX tokens. This sum then goes to the “staking rewards pool”. When staking tokens, the token holder receives a portion of the tokens from that pool. The staking mechanism is described in more detail below.

- Allocations and vestings are at the benchmark level. Immutable’ allocations, vestings, and cliffs are fixed at values close to the best practices, which indicates a sound distribution of funds in the protocol.

- Detailed description. The whitepaper of Immutable includes not only the token utility and allocations but also explanations of the processes taking place in the protocol; for instance, there is a detailed explanation about NFTs trading process. Moreover, the whitepaper includes all investment risks associated with the IMX token.

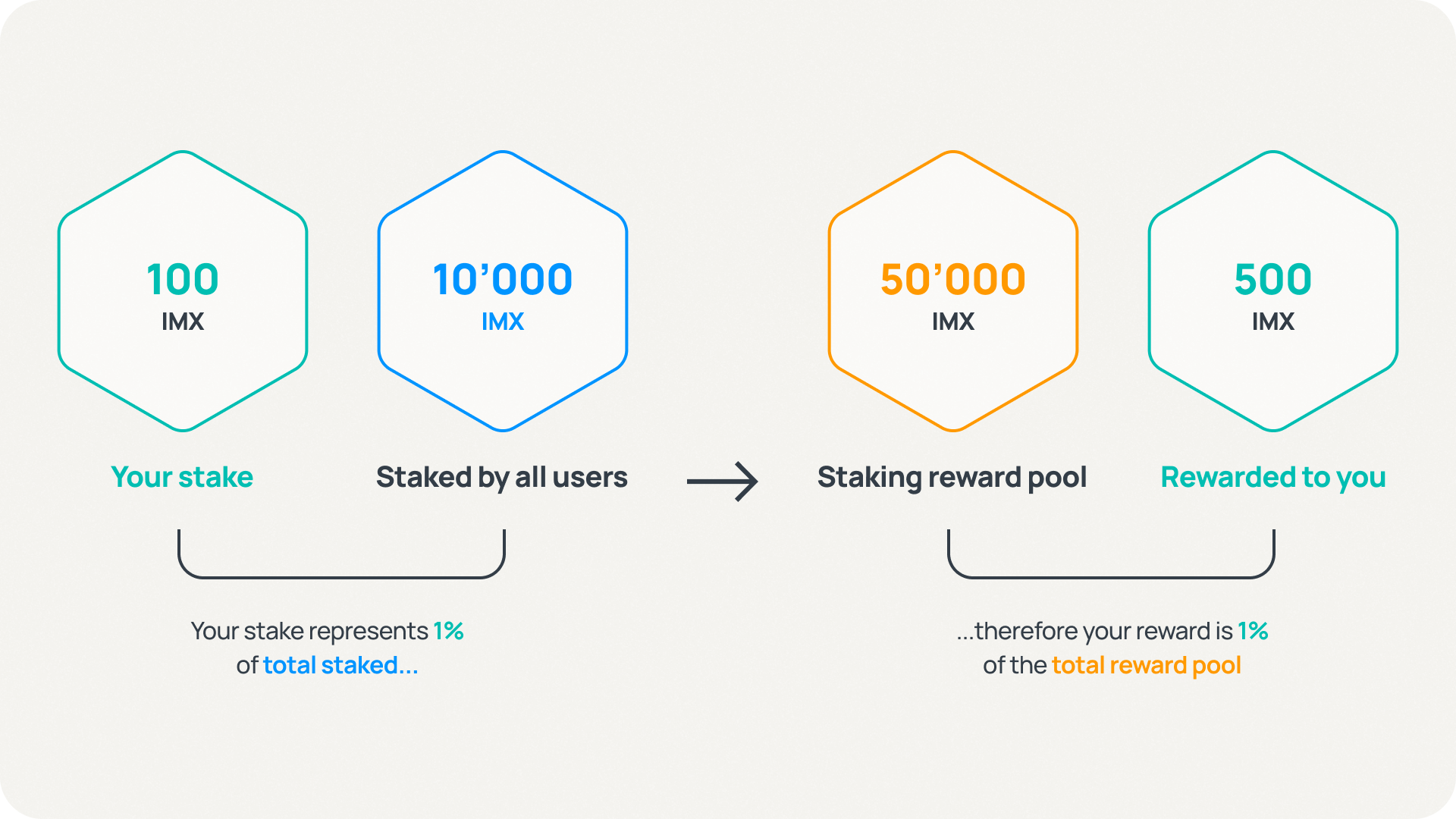

Token utility

As mentioned above, the IMX has three main functions described in the whitepaper. The protocol itself solves the problem of rewarding holders through staking and token circulation in the system, using its utility. In this system, when a user performs an operation, they pay 20% of the fee in tokens. This fee goes into a “staking rewards pool”, which is used to reward token holders. To get a reward in tokens, users have to stake their tokens. By staking tokens, holders receive tokens from this pool. Their portion corresponds to their percentage of the total number of staked tokens, as shown below (Figure 1). These interconnected utilities are aimed at solving the protocol's key tasks: attracting investors and liquidity.

Allocations, vestings, and cliffs

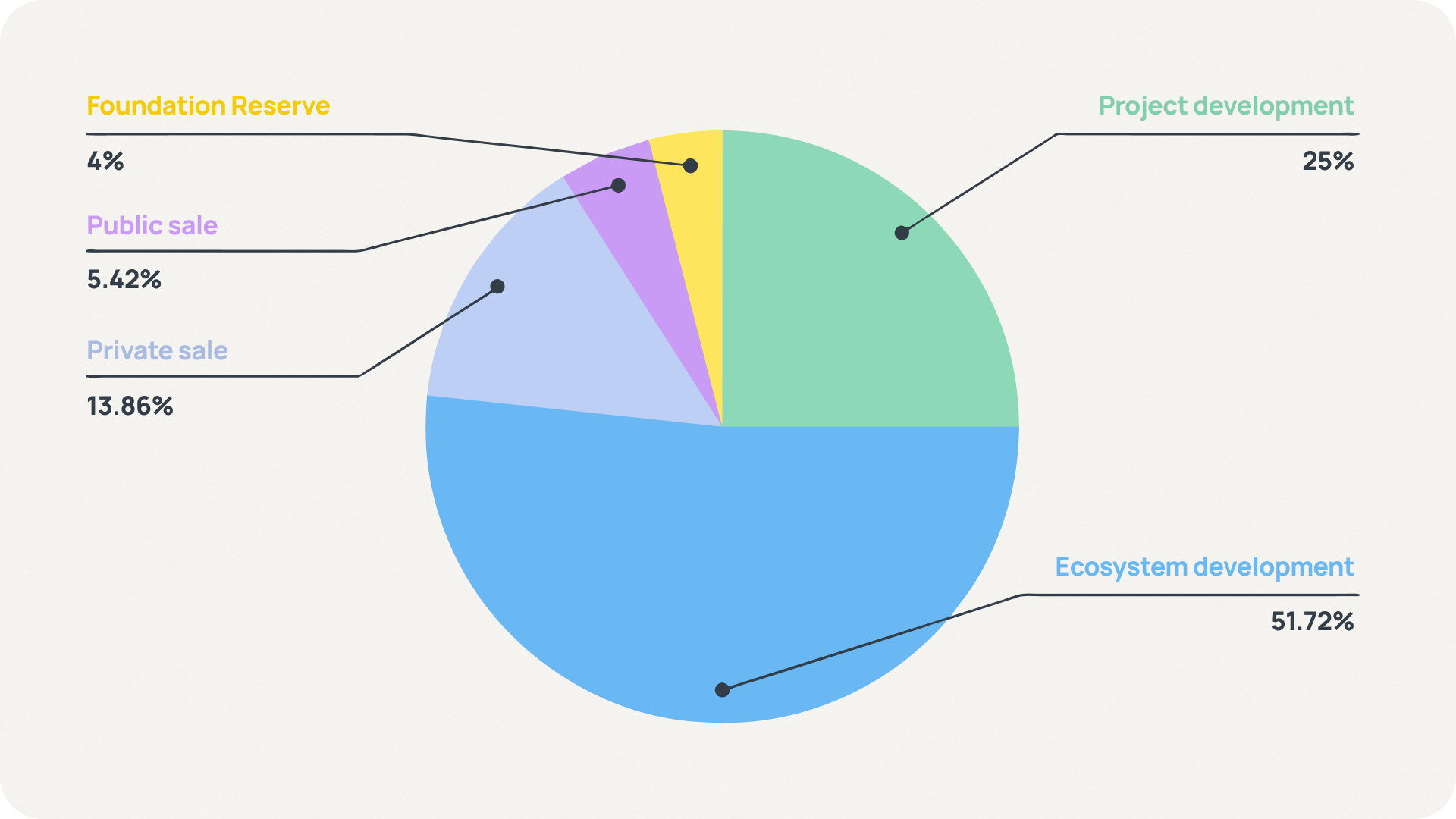

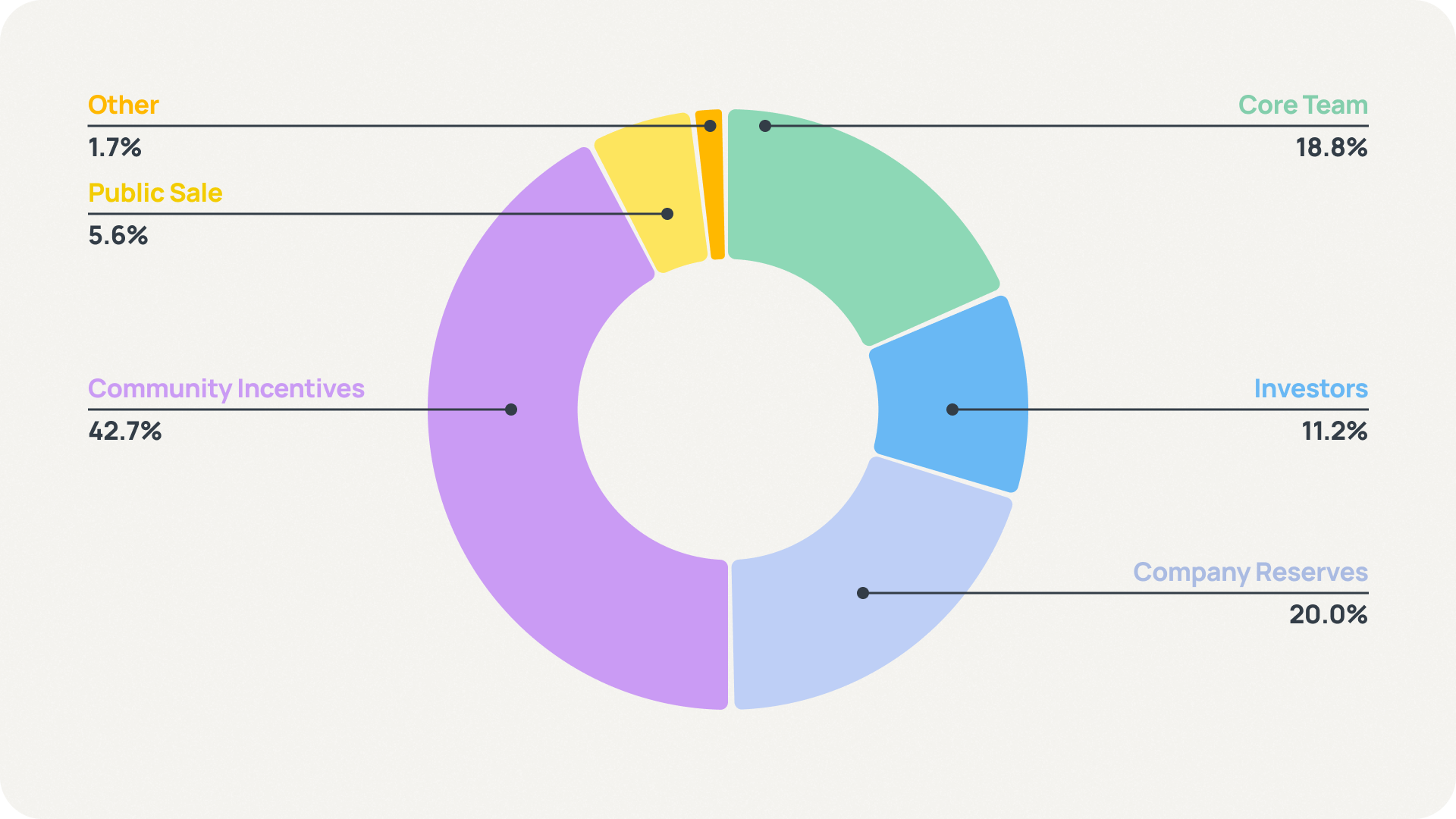

As we mentioned earlier, Immutable’s allocations are very close to market standards. Figure 2 represents allocations of the Immutable project (2,000,000,000 IMX tokens), displaying categories and the percentage ratio of tokens. Figure 3 represents market standards of allocations.

Please note that the figures 2 and 3 have slightly different indicators (1%-9%), however, differences over 5% in certain categories are considered acceptable as they encompass additional categories within them. Moreover, in the whitepaper of the project, there is not only a classical pie chart with allocations but also a table where each category has a description of the processes to which tokens will be allocated.

Let’s take a look at the vestings and cliffs (Figure 4).

Vesting/lockup periods are between 3-4 years for Core Team members and 2 years for Investors.

The most important goal of the vesting process is to prevent token devaluation by avoiding the sudden release of a large quantity of coins into the market. It can be seen from the project’s vesting schedule, that the majority of groups do not overlap with each other, which avoids a situation where several groups simultaneously hold a large number of tokens and can sell them. This ensures that token sales will be more gentle on the price and protocol.

Overall impression of the whitepaper

It is important to note that the main goal of the whitepaper is to provide maximum detailed and understandable information, enabling investors to draw conclusions about the project. If you look at the entire whitepaper of the project, it has a well-structured format and a detailed description of processes. For instance, when mentioning the vestings and cliffs, it not only provides a schedule but also explains the mechanism behind this tool. Additionally, the documentation outlines all the investment risks associated with the token, which can be beneficial for novice investors who are not yet capable of conducting independent, in-depth analyses and identifying risk factors. Most of the mentioned processes are accompanied by graphical explanations, such as token redistributions during staking. Furthermore, the project elaborates on the workflow process and highlights the main instruments used in the protocol.

Conclusion

The tokenomics of Immutable's IMX token is considered high-quality due to its useful and interesting token utilities, benchmark-based allocations and vestings, and detailed description in the whitepaper. The whitepaper provides comprehensive explanations of token utility, allocations, vestings, and investment risks, allowing investors to make informed decisions. Overall, the tokenomics of Immutable demonstrates careful planning and consideration for the long-term viability of the project.

Comments ()