Blast L2 solution

A quick forenote: why is Blast worth discussing?

In contrast to conventional rollups, Blast has a unique method for staking payouts. The network rewards all users who deposit ETH into the protocol, as opposed to depending just on validators. This novel technique promotes a more decentralized network and encourages involvement.

Key takeaways

- Blast L2 has had over $230M TVL inflow in 2 days (Nov 2023), catapulting it into the top 15 chains by TVL (total value locked, the total number of assets locked or staked in a protocol by users).

- The airdrop mechanics are not straightforward, but the report describes strategies for maximizing airdrop farming, like the 3-wallet strategy. With 75% of wallets depositing less than $1k, this strategy has already found widespread application.

- With the use of resources like ether and stablecoins, users can create passive income on Blast's platform thanks to a special feature called native yield.

- Many aspects of the launch resemble a pyramid/Ponzi scheme, but so far it has been successful in driving deposits. It remains to be seen if the project manages to sustain long-term interest beyond the airdrop.

Description of the project

Blast is an Ethereum Layer-2 (L2) platform created by the team behind Blur, a popular NFT marketplace protocol that shared the top marketplace ranking by volume in 2023 with OpenSea. Blast strongly emphasizes countering asset depreciation by offering interest rates of 4% for ETH and 5% for stablecoins deposited on the network. The project attracted significant investment, raising $20 million from influential backers such as Paradigm, Standard Crypto, eGirl Capital, Primitive Ventures, and Andrew Kang. The project's development is spearheaded by Pacman, who founded Blur. Before the launch of the main network, they deployed a Multisig wallet where users can pre-fund their Blast account, and earn interest on ETH and stablecoins while earning Blast Points.

What is unique about it?

Blast has a feature called native yield that allows users to generate passive income on its platform using Ether and stablecoins.

Here's how it works:

- ETH Staking: If users hold ETH tokens, they can choose to stake them on Blast to support the network. By staking their tokens, they contribute to the network's security, as malicious activities would require control of a majority of all staked tokens. They also receive additional ETH as a reward.

- Reward Distribution: The additional ETH rewards earned through staking are passed on to users on the Blast platform. This means that users can earn passive income by simply holding ETH on the platform.

- Stablecoin Yield: Stablecoins such as USDC, USDT, and DAI automatically engage in on-chain Treasury Bill protocols on Blast. These protocols provide a return over time, generating a yield on the stablecoins.

- Yield Distribution: The generated yield from stablecoins is distributed to users on the platform. This means that users holding stablecoins can also earn passive income and potentially increase the value of their assets over time.

In addition to the native yield feature, Blast also utilizes optimistic rollups, a technique that improves transaction processing on the Ethereum network. Here's how it works:

- Transaction Batching: Instead of processing transactions individually, Blast bundles multiple transactions into a single batch, known as a rollup.

- Verification on Ethereum Mainnet: The rollup, containing multiple transactions, is then submitted to the Ethereum mainnet for verification.

- Improved Throughput and Lower Fees: By batching transactions, Blast can process thousands of transactions per second (TPS), significantly increasing the network's throughput. This is a vast improvement compared to the Ethereum mainnet's current capacity of around 15 TPS. Additionally, the efficiency gains introduced by optimistic rollups lead to lower transaction fees.

With Blast, users can expect to pay a fraction of the fees incurred on the Ethereum mainnet, making transactions more cost-effective for everyday use.

What is all critique about?

Since its announcement, Blast has garnered the attention of crypto-enthusiasts at various levels. Many have pointed out significant flaws in the project's logic and functioning:

- The Layer 2 network's 3-of-5 multisig and centralization pose a significant security risk to user assets.

- Blast is built upon a modifiable smart contract.

- During the launch of the testnet and the developer's Big Bang Competition (17.01.24), only the cross-chain bridge was available to network users from the functional applications.

- Funds sent to protocol addresses are not refundable for three months after they are sent (up to Feb. 24, 2024).

- There is a lack of full-fledged technical documentation describing the yield mechanism.

- The L2 protocol only gathers user payments and distributes them to other DeFi platforms.

The protocol is positioned as the only L2 solution in the Ethereum ecosystem that offers income on deposits in ETH and stablecoins. However, almost all the funds that users are attracted to are placed on DeFi platforms such as Lido and MakerDAO. At the moment, the rate of return on external protocols matches Blast's claims (4% for ETH deposits and 5% for stablecoin deposits). Additionally, the platform has no mechanisms in place to maintain user yields in case of rate changes.

All of these deficiencies are significant and raise doubts about the project's long-term viability.

Blast vs other Layer-2 chains

There are several trending L2 platforms right now: Base, Arbitrum, and Optimism.

- Base: Coinbase introduced Base Chain in 2023. Base provides security, stability, and scalability for on-chain apps, a low-cost environment for DeFi and on-chain traders. Coinbase is a prominent figure in the crypto industry, and the blockchain developed by them is a major player, too.

- Arbitrum: Arbitrum is a technology suite designed to scale Ethereum. It can be used to do all things you do on Ethereum — use Web3 apps, deploy smart contracts, etc., but your transactions will be cheaper and faster. The flagship product — Arbitrum Rollup — is an Optimistic rollup protocol that inherits Ethereum-level security.

- OP Mainnet: OP Mainnet is a fast, stable, and scalable L2 blockchain built by Ethereum developers, for Ethereum developers. Built as a minimal extension to existing Ethereum software, OP Mainnet's EVM-equivalent architecture scales your Ethereum apps without surprises. If it works on Ethereum, it works on OP Mainnet at a fraction of the cost.

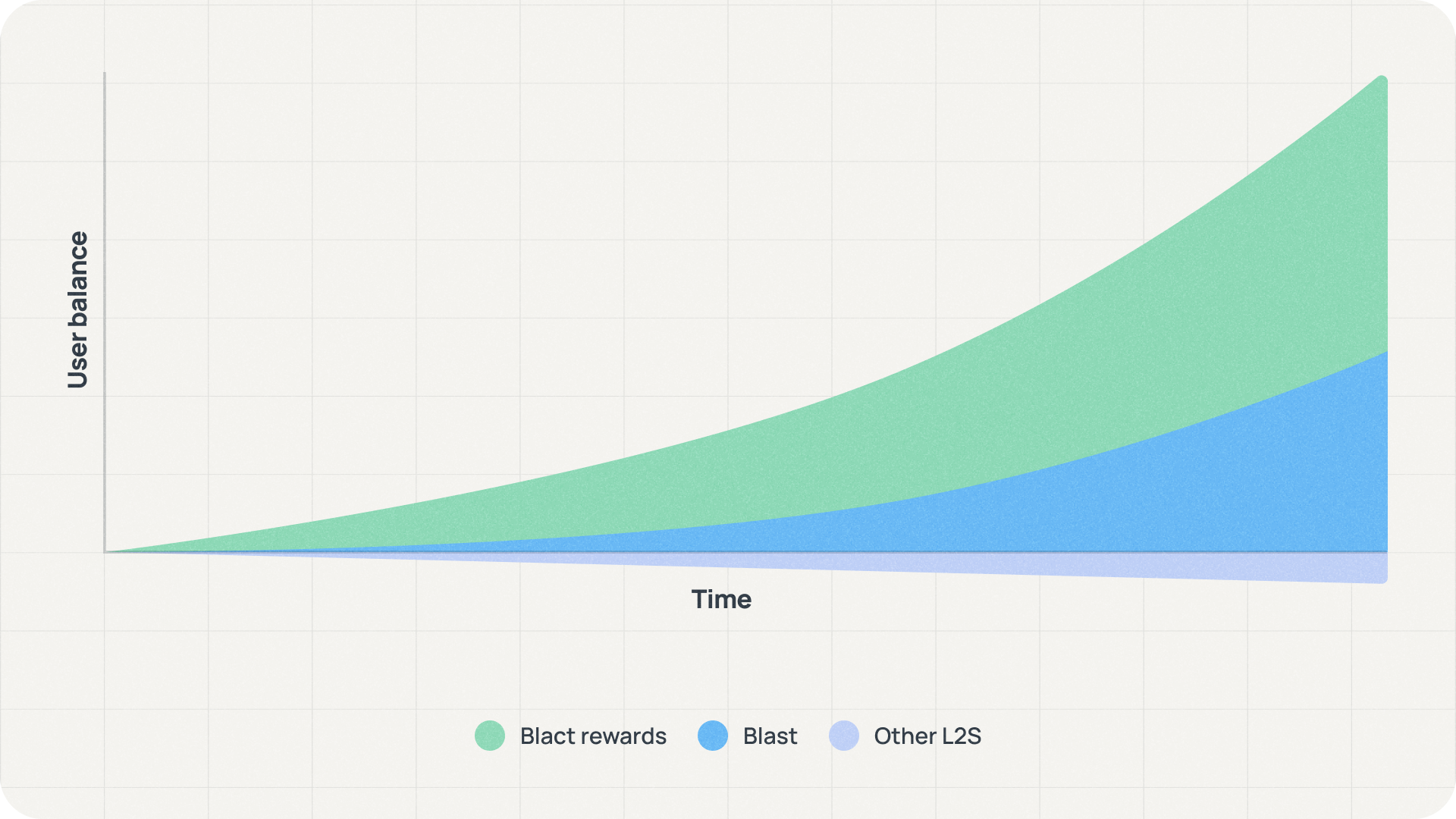

Blast is distinguished from other L2 chains mainly by its natural yield feature (Figure 1). Because Blast allows assets to earn yield natively, it offers another layer of value, whereas other L2s concentrate on scalability and transaction speed. This strategy improves the user experience and suggests a new benchmark for L2 platforms, which may cause the blockchain community to reevaluate its expectations.

Conclusion

Blast differs from other Layer-2 chains because of its distinct native yield feature, which enables assets to produce passive revenue. This sets it apart from other networks that prioritize the speed and scalability of transactions. With its emphasis on countering asset depreciation and offering competitive interest rates, Blast aims to provide users with a way to earn income from their assets and potentially increase their value over time. While some aspects of the launch may resemble a pyramid/Ponzi scheme, the project has gained significant traction with a large TVL inflow. Whether Blast can maintain interest over the long run and prove to be a viable L2 platform after its initial airdrop phase is still to be seen.

Comments ()